SMBC Sydney reflects on its record-breaking domestic deal

Sumitomo Mitsui Banking Corporation Sydney Branch (SMBC Sydney)’s latest transaction was the largest-ever Australian dollar deal from a bank with offshore parentage. It was also the largest credit deal since the onset of the COVID-19 crisis.

Momentum built in the Australian dollar market in the second half of May, with senior deals priced by a handful of banks either in Kangaroo or domestic format through local branches. However, SMBC Sydney’s A$2.4 billion (US$1.7 billion) multi-tranche deal eclipsed all for volume. The issuer says interest in the deal exceeded its expectations.

Only a Macquarie Bank deal from February 2020 sits above it on the list of largest Australian dollar senior deals by banks outside the domestic big four (see table). The absence of issuance by the major banks has opened up significant volume opportunities for other financial institutions, particularly those seeking to expand their local balance sheet in the wake of the crisis.

The deal was SMBC Sydney’s second in the Australian dollar market so far in 2020, after an A$800 million, two-year floating-rate note print in February. The borrower says it may be active again before the year is out, depending on credit growth. Its latest deal was its first in Australian dollars to include a fixed-rate tranche.

Largest-ever Australian dollar senior bank deals, excluding big-four banks*

| Pricing date | Issuer | Tenor(s) | Total volume (A$m) | Margin (bp/swap) |

|---|---|---|---|---|

| 6 Feb 20 | Macquarie Bank | 1 & 5 | 2,500 | 41 & 84 |

| 2 Jun 20 | SMBC Sydney | 3 & 5 | 2,400 | 95 & 115 |

| 14 Jun 19 | Macquarie Bank | 1 & 3 | 2,250 | 43 & 75 |

| 5 Jul 05 | Wells Fargo | 5 | 2,000 | 23 |

| 24 Mar 11 | Lloyds TSB Australia Branch | 3 | 1,850 | 220 |

*Excluding government-guaranteed deals

Source: KangaNews 11 June 2020

Source: SMBC Nikko, TD Securities 11 June 2020

Deal pricing

Issuer name: Sumitomo Mitsui Banking Corporation Sydney Branch

Issuer rating: A/A1/A

Pricing date: 2 June 2020

Total volume: A$2.4 billion

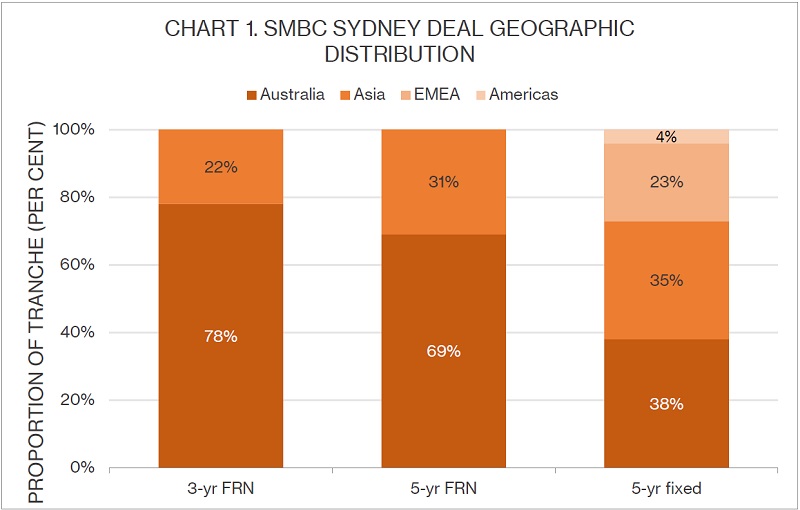

Geographic distribution: see chart 1

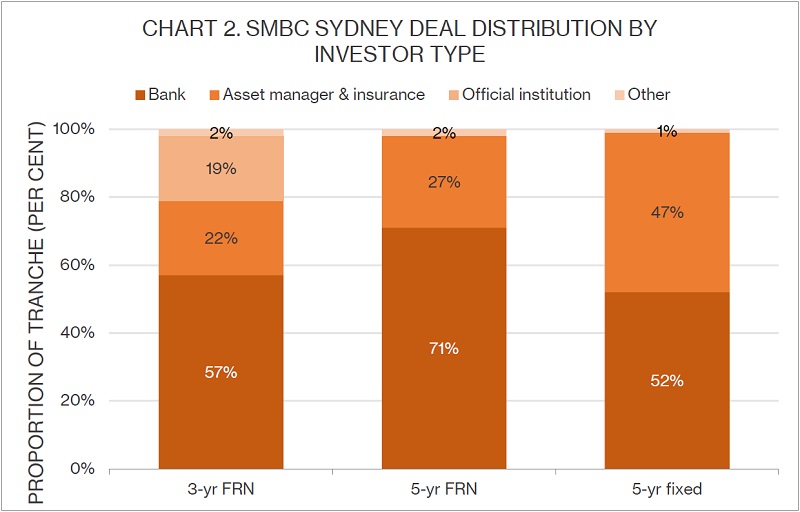

Distribution by investor type: see chart 2

Lead managers: Commonwealth Bank of Australia, Macquarie Bank, SMBC Nikko, TD Securities, Westpac Institutional Bank

Three-year FRN tranche

Volume: A$1.2 billion

Coupon rate: 3m BBSW +95bp

Issue/re-offer price: par

Margin to swap: 95bp/3m BBSW

Five-year FRN tranche

Volume: A$1.025 billion

Coupon rate: 3m BBSW +115bp

Issue/re-offer price: par

Margin to swap: 115bp/3m BBSW

Five-year fixed rate tranche

Volume: A$175 million

Coupon rate: 1.5%

Issue/re-offer price: 99.689%

Issue yield: 1.565%

Margin to swap: 115bp/s-q

Source: SMBC Nikko, TD Securities 11 June 2020

“We have seen increased demand from our customers in recent months. SMBC Sydney takes a long-term view of its relationships and expects this to continue. This is the first public debt issuance for the SMBC Group since the COVID-19 crisis began, which shows its importance. The success will lead to more issuance in other markets from SMBC.”

“SMBC Sydney has been building a strong presence and curve in the domestic market for more than 10 years. Comps provided for this deal were domestic rather than offshore, given the specific differences in liquidity and facilities offered in Australia compared with the rest of the world.”

KangaNews is your source for the latest on the COVID-19 pandemic’s impact on Australasian debt capital markets. For complete coverage, click here.

WOMEN IN CAPITAL MARKETS Yearbook 2023

KangaNews's annual yearbook amplifying female voices in the Australian capital market.

SSA Yearbook 2023

The annual guide to the world's most significant supranational, sovereign and agency sector issuers.