A decade of development

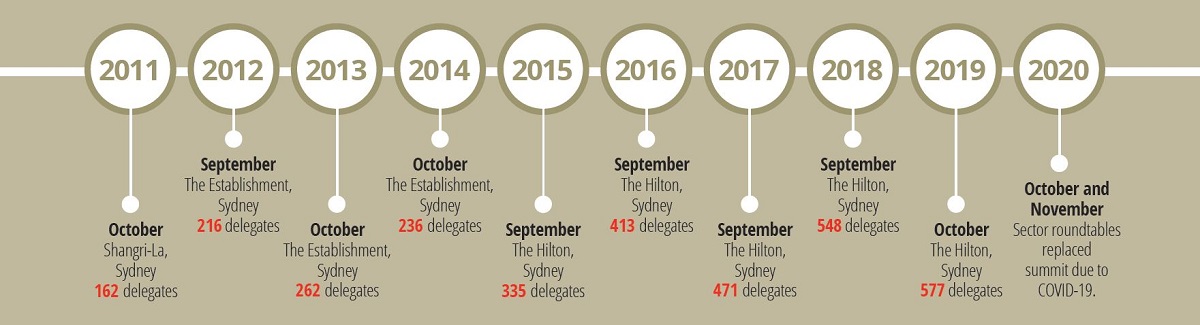

The KangaNews-Westpac Corporate Debt Summit debuted in 2011, with a relatively small audience and a market that could not yet take consistent supply of corporate bonds for granted. In the decade since, the event and the market have grown and diversified. By 2019 – the last year before COVID-19 put the in-person event on hiatus – registrations had more than trebled, to nearly 600, and the event’s agenda covered not just corporate debt but a raft of issues relevant to the economic and business environment.

Along the way, landmarks include the introduction of an annual ‘view from the C-suite’ session, the view from the US private placement sector, coverage of the emergence and accession to the mainstream of sustainable debt and – perhaps most importantly – the background of a more confident and consistent Australian issuance environment.

2011

“We continue to be in the early phase of development domestically and the market suffers from dislocation from time to time. The US market is currently open to investment-grade issuance. The Australian market is also open, but to a much smaller extent. It is a little bit chicken and egg: the more issuance we get, the more interest we will see from investors.”

“Many funds have mandates that will not let them invest in bonds longer than five years as they need to be able to switch out – into equities. We need to challenge the accepted notion that we should have 60-70 per cent allocation into equities, especially with people coming into the retirement phase of their life cycle. People in the bond market need to have a longer-term view with confidence of having more money to put to work – this is the real key to getting more triple-B and longer-tenor issuance.”

“We see more consistent and worthwhile deal size being achievable for many issuers these days, and a greater range of credits accessing the market. That said, the local market still has some challenges. We still cannot get significant volume in tenors beyond five years, while there remain issues around execution and the lead time required to issue. We remain cautious about the domestic market but we are confident it will develop further.”

“Prior to the financial crisis, domestic corporate deals were being issued on a weekly basis and one of the main concerns was making sure we were not going to clash with our peers by issuing at the same time. Whereas now such deals are few and far between so we are unable to make an informed assessment of the market based on consistent deal flow.”

“To see greater allocation to fixed income we would need to see sustained good performance from the asset class. This has happened – but it will be hard to repeat unless rates fall further. Investors are currently not scared enough to move much of their allocation out of equities. Headline risk in fixed income – particularly around CDOs, mortgage funds and property debentures – needs to subside.”

“The relationship between issuers and investors has had a very rocky road, particularly in the last few years. There are significant points of contention regarding different covenant structures, legal structures and onshore versus offshore issues. Communication is definitely an area where Australian investors have always been down the list of priorities. The last three years have done a lot to change the environment – companies are a lot more thoughtful about the entire spectrum of their investor base, not just equity holders.”

2012

“If you have a long-term business plan where you want to raise debt over an extended period, relationships are important. We can develop those long-term relationships in the USPP market, as we can with the banks in Australia. But the domestic bond market just doesn’t seem to have the volume to support the things we want to do.”

2013

“Five or six years ago, execution risk was high. But I get the sense from talking to other borrowers that it is a lot lower now and I’d like to think we would attract interest if we were to issue. However, if we go offshore we can get 10-, 12- and even 15- or 20-year issuance. Five years only matches what we can achieve in bank funding.”

2014

“Super funds, many of which are our clients, face a real dilemma. They have yield thresholds that were set when rates were much higher. Our experience is that these have not been adjusted too much even though rates have collapsed. We suggest these clients lock in spread, go floating rate and take a long-term view of what the risk-adjusted return should be.”

“It is very much an issuer’s market. If I was a triple-B rated company I would be issuing as much debt for as long as possible given where spreads are. The challenge is that right at the time in which we have been calling for more triple-B issuance – and a longer-dated market – investors are becoming less willing to hold higher-beta names purely on a valuation basis.”

“If there is one thing that would improve the Australian market, it would be if an issuer could always assume it is open for business. Corporates are just not geared up to doing things instantly and there will often be a long gestation period before we are ready to launch. We would like to know a particular market will still be open after we receive board approval to issue into it.”

“There is inevitably a size factor that has an impact on domestic-market discussions, whether it is a vanilla corporate deal or something more structured. But I don’t think it is a question of a lack of capability in the domestic market: I think it is getting the right opportunities to the right people.”

2015

“One of the big questions about balance-sheet repair following the financial crisis was whether it was going to be cyclical or structural. Across the rated universe, it has been more structural than cyclical. We are not seeing any strong desire to gear up, while leverage remains at modest levels – this is a function of boards and management continuing to be conservative.”

2016

“The effectiveness of QE has probably come to an end globally. Led by the US, since 2015 we have seen corporates putting less into capex – even with QE ongoing – and using more cash for dividends and share buybacks, or stockpiling it for potential M&A. While it appears there is too much money in the system, the indications also are that there are too many uncertainties for corporates to be comfortable investing.”

“The market has faced significant headwinds in the past 12 months, and although volume is largely unchanged its makeup is quite different. But I believe the fact we have been able to welcome sizeable transactions from global, blue-chip issuers demonstrates the growth of the domestic option’s breadth and depth.”

“I believe it will still fall to institutional investors to take on the role, from the banks, of lending to corporations and creating a more vibrant bond market in Australia. Retail investors tend to have a yield focus in fixed income, which makes it less likely that they will become drivers of demand for senior debt.”

“Australia has managed to produce stable growth of around 3 per cent for many years, in the face of some huge cycles. One of the key hopes if we want to maintain this has to be that we continue to build on growth in services exports – which will be highly sensitive to appreciation in the Australian dollar. It will be absolutely critical for the Australian economy to benefit from the development of the Asian middle class.”

“A common reaction to the emergence of fintech from people in financial services is fear: ‘oh my goodness, we are all going to be replaced by machines’. But we are just not going to get to a point in the foreseeable future at which machines can do everything we do. The real question ought to be how we augment our processes, using technology to do what we do better.”

2017

“It is important to understand that the structure of our market has changed significantly – by default we have more liquidity in our portfolios relative to 2007. In aggregate, portfolios are structured with pools of liquid assets and less-liquid credit assets. Investors referencing history should have a clear understanding that credit is not liquid during risk-off scenarios.”

“Institutional-investor cash flows have been directed into the USPP market at an increasing rate. Active investors have stepped up their game as they see USPPs as a preferred asset class, large European investors have decided to follow suit and the number of large-bid investors has continued to increase.”

2018

“I don’t think ESG is such a new concept. We have been building E, S and G factors into our analysis for many years. What we are doing now is more an extension of what we already had. Our approach historically has been to embed ESG into our research. The change has been to make what we had previously embedded more explicit.”

“The big mistake ahead of the financial crisis was the belief that risk had been sliced and diced and distributed to all the ‘right’ places. The mistake this time around could be the idea that unwinding QE will be quick or easily managed. When bonds have been issued at ridiculous prices it doesn’t take a credit event – it just needs funds to go red and redemptions to start, which stops cash flowing back into the primary market.”

“The biggest issue we are going to face in the next few years is the QE unwind. How we remove US$10 trillion of liquidity while taking rates from zero back to a long-term norm, in an environment where intermediation has all but disappeared, will be a huge challenge. I think what we will see is long periods of very low volatility studded with short periods of hyper volatility.”

2019

“When we rate a credit lower internally than what the rating agencies have, 60 per cent of the time it is because we have assigned a high ESG risk factor. This is important to our internal rating and it feeds directly into portfolio positioning. Each time we have changed an ESG rating and subsequently changed our internal rating, it has resulted in altering the position of the credit in our portfolio.”

“Investa has reached a point where we can call banks and ask for ‘grey pricing’ and ‘green pricing’ for a debt facility. At the moment, banks are wearing the price difference. I would like to see APRA introduce a new tier of capital to deal with this – and I think this is when we will see sustainable loans become commonplace.”

“The pie has become bigger so funds under management in fixed income are growing. Sometimes this means ticket sizes are growing but more commonly it means investors need to look more broadly at where they can source assets, including strategies where they can invest offshore to get the diversity they need.”

“We view loans and bonds with margins linked to sustainability performance principles as transition instruments. We expect them to be an important component of the Australian market for some time as we transition to a low-carbon and more sustainable economy. Once an entity’s sustainability performance goals have been met, it will potentially have assets it can use for issuance in a GSS bond.”

2020

“While we were still cautious, we gained a lot of confidence from seeing the actions taken throughout the REIT sector including equity raises, withheld dividends and delayed capex. This got us comfortable to invest into the sector as early as May.”

“The CFOs we have spoken to believe enforced social distancing and working from home has proven successful. They have been able to continue operating and, in the longer term, see this as an opportunity to revisit their tenancy requirements and potentially reduce costs.”

“We were surprised at how long it took some issuers in the sector to tap the local market after going to their banks to shore up liquidity positions. A lot of issuers were not confident that the market would be there, but there is a lot of capital floating around for corporates.”

“Mobility trends suggest we may see a level of disruption across transport modes for some time to come. It is an opportune time for governments and industry to work together to ensure we have efficient and resilient transport networks into the future.”

“We formed a clear view about how bad things would get. The unknown factor was for how long the downturn would persist and what the recovery would be like. Ultimately, though, if you want to get around Australia you need to fly. We believe there will be desire for travel – for leisure and, eventually, business too.”

WOMEN IN CAPITAL MARKETS Yearbook 2023

KangaNews's annual yearbook amplifying female voices in the Australian capital market.