South Australian Government Financing Authority

About South Australian Government Financing Authority

South Australian Government Financing Authority (SAFA) functions as the central financing authority for the state of South Australia (SA). SAFA is also the state’s captive insurer and undertakes a range of commercial advisory and financing activities.

SAFA plays an integral role in the management of the state’s finances and risks, harnessing economies of scale and relevant expertise to provide a range of treasury, insurance, and commercial advisory services to public-sector clients.

Ownership

SAFA was established in 1983 under the Government Financing Authority Act 1982 (SAFA act). It is a statutory authority constituted by the under treasurer of SA. It is subject to the control and direction of the treasurer of SA. Since its establishment, SAFA’s functions have expanded to include a range of financing and commercial advisory activities on behalf of the state government. This includes being the government’s captive insurer since 2006.

Guarantee structure

Liabilities incurred or assumed by SAFA are guaranteed by the treasurer under the SAFA act.

Risk policy

SAFA is exposed to financial and operational risks in its treasury, insurance and commercial activities. It has a robust risk-management and reporting framework encompassing the three-lines-of-defence model. Its corporate-governance arrangements include an independent advisory board.

Funding strategy

SAFA funds the SA public financial and nonfinancial sectors through a blend of fixed- and floating-rate short- and medium-term borrowings. Its principal source of medium-term funding is through the issuance of its select-line bonds. Short-term funding for liquidity-management purposes is obtained through SAFA’s one-year AONIA-linked FRN issuance, CP and ECP programmes.

| SECTOR | SUBSOVEREIGN |

| CREDIT RATINGS (S&P/M) LONG-TERM AUD |

AA+/Aa1 (negative/stable) |

| CREDIT RATINGS LONG-TERM FOREIGN CURRENCY |

AA+/Aa1 (negative/stable) |

| FOREIGN-CURRENCY PROGRAMMES | ECP |

| FOREIGN-CURRENCY ISSUANCE SINCE JAN 2020 |

N/A |

| TERM FUNDING REQUIREMENT (A$BN) |

FY21 FY20 FY19 7.6 3.9 3.8 |

| RBA REPO ELIGIBLE | YES |

| RBNZ REPO ELIGIBLE | NO |

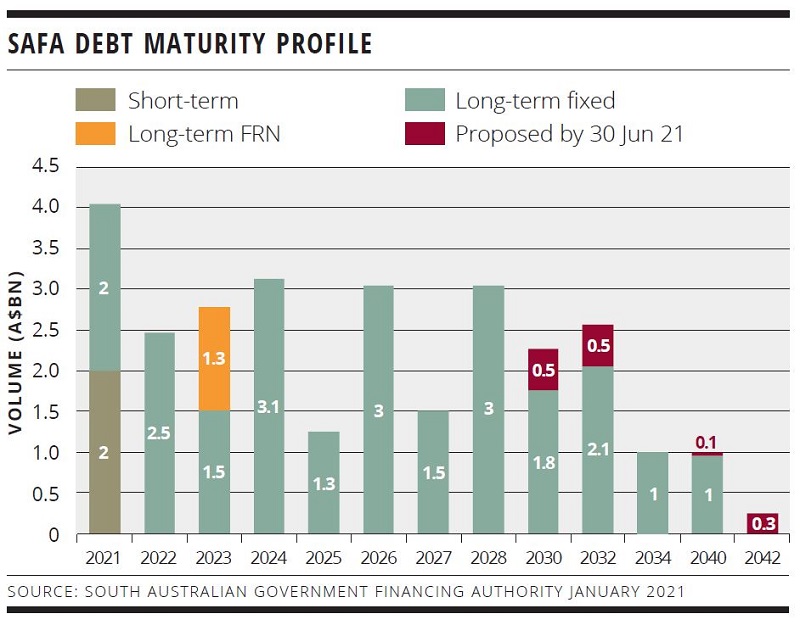

SAFA’s 2020/21 gross funding requirement is A$7.6 billion of which A$1.3 billion was pre-funded in 2019/20. The net A$7.6 billion includes A$5.6 billion of new money required for client borrowing including the general-government sector and refinancing future maturities of A$2 billion.

SAFA’s funding strategy will continue to focus on long-term domestic benchmark select line bonds and short-term funding via domestic CP and one-year AONIA-linked FRNs. SAFA may continue to tap offshore markets for ECP funding when conditions are favourable, with any issuance fully swapped into Australian dollars.

Following a comprehensive overhaul of its liquidity management, SAFA has continued with its strategy by issuing select-line bonds maturing in even years and targeting outstanding volume of A$3 billion per line. It has also continued to extend its curve toward 15 years and will monitor opportunities for further lengthening based on borrower requirements and demand. In 2020/21, SAFA issued its first nonbenchmark 20-year bond.

SAFA does not intend to access offshore markets for EMTNs or to issue inflation-indexed bonds. As at 31 January 2021, SAFA had A$24 billion of domestic fixed- and floating-rate select-line bonds on issue and A$2 billion outstanding under its short-term debt programmes, including A$860 million in AONIA-linked FRNs.

FOR FURTHER INFORMATION PLEASE CONTACT:

Andrew Kennedy, Director, Treasury Services

+61 8 8429 0416

This email address is being protected from spambots. You need JavaScript enabled to view it.

HIGH-GRADE ISSUERS YEARBOOK 2023

The ultimate guide to Australian and New Zealand government-sector borrowers.