WiBF National Industry Awards

WiBF 2024 National Industry Awards celebrate the talented individuals leading by example across Australia’s banking and finance industry, as well as those organisations working to improve the gender diversity across the sector. Our mission at WiBF is to make a tangible impact on gender diversity in the banking and finance sector, with an emphasis on increasing the representation of women in key leadership positions.

NOMINATIONS NOW OPEN – NOMINATIONS WILL CLOSE 17th MAY 2024

Nomination Process

Nominations for WiBF’s 2024 National Industry Awards are now open!

Special thanks to Judgify for providing a smooth online nomination process.

The Judging Process

The awards judging panel will review all nominations across each award category, from which they will select the winners.

Special thanks to KangaNews for sponsoring the Judges Recognition Gifts.

The Awards Luncheon

The winners for each category will be announced at the WiBF Awards Luncheon at the ICC Grand Ballroom on 5th September 2024.

The Honour Board

Winners from all categories will receive a trophy and certificate, and a place on the online WiBF Honour Board in perpetuity. Previous winners can be seen on our WiBF Honour Board.

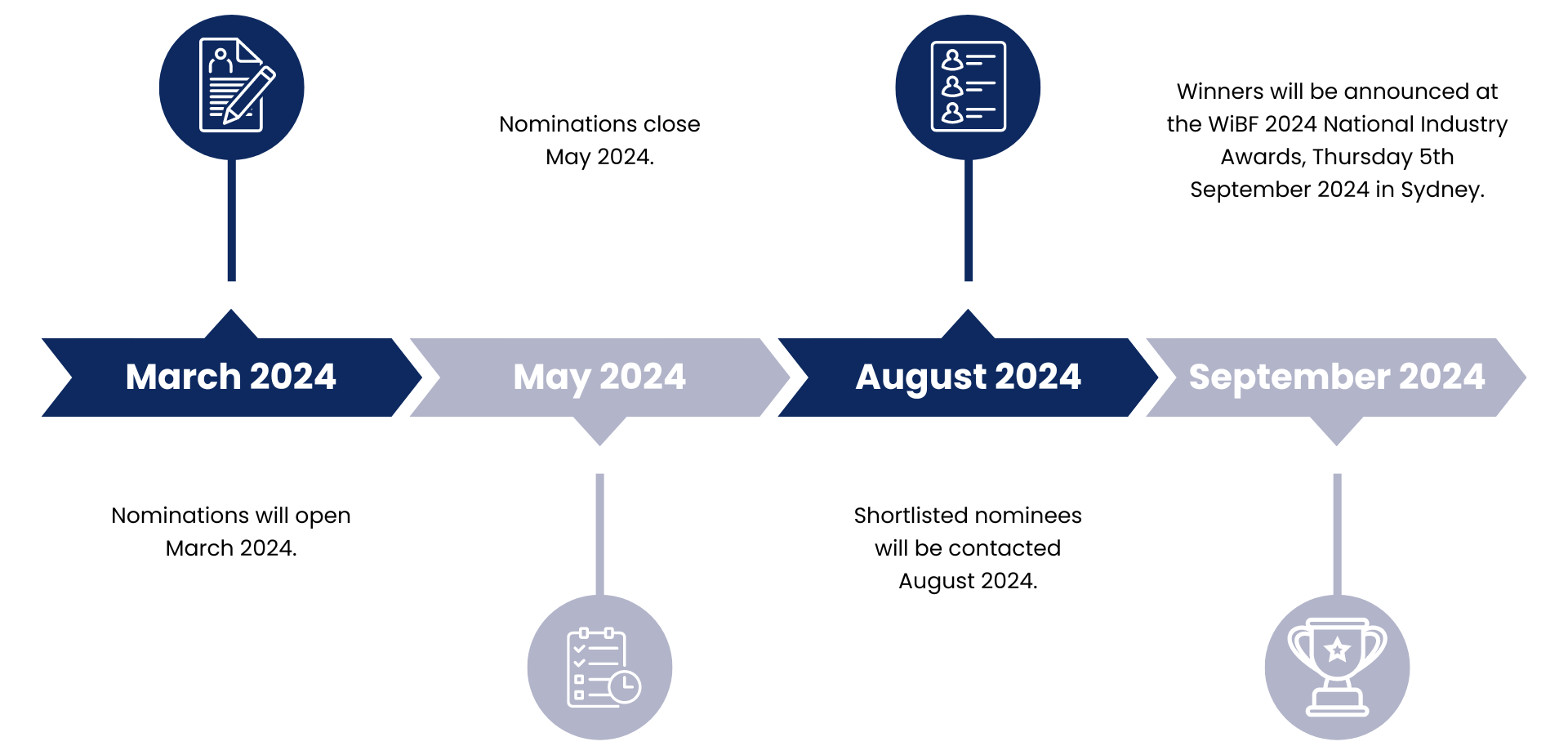

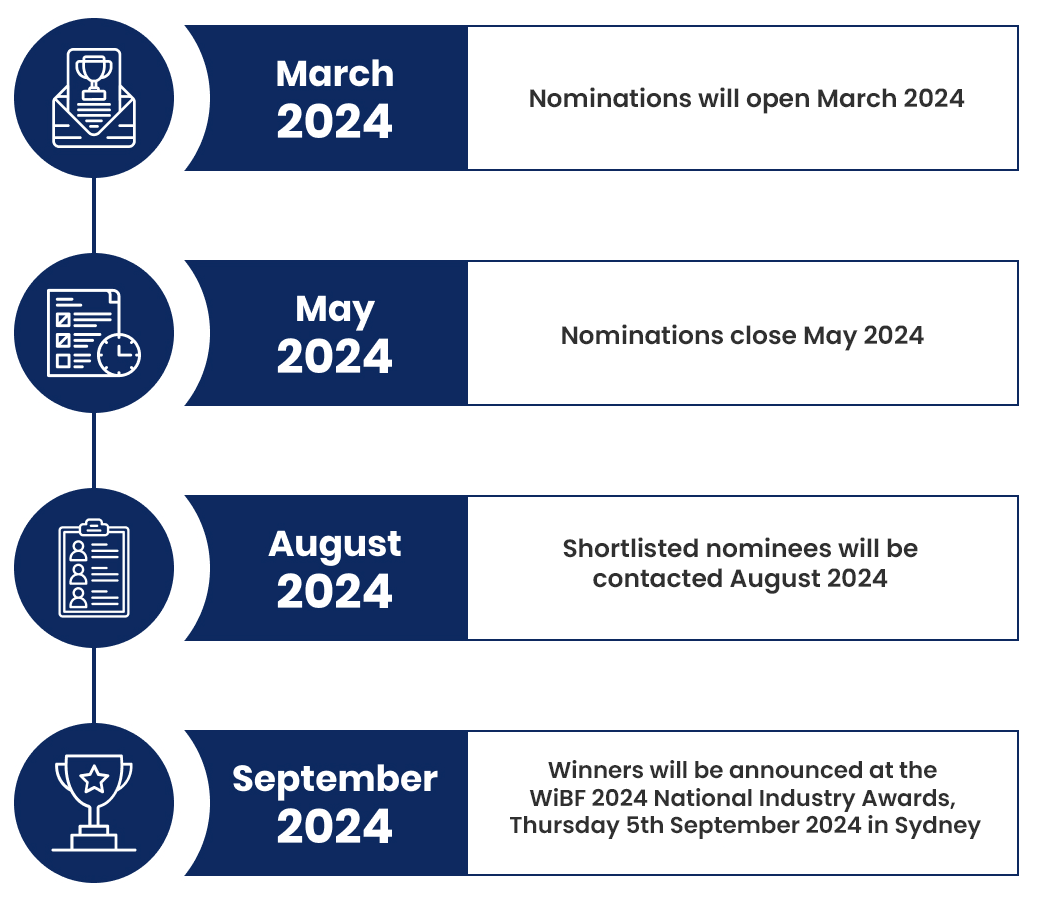

Timeline

2024 National Industry Award Categories

Proudly sponsored by Commonwealth Bank of Australia, the 2024 National Industry Awards will recognise exceptional individuals and organisations in 16 Award categories this year. A panel of esteemed judges will review each entry and the winners will be announced at the Awards Luncheon Thursday 5 September 2024, at the ICC Grand Ballroom, in Sydney.

“This prestigious award celebrates the outstanding individuals who have demonstrated exceptional performance, innovation, and leadership in the field of investment and fund management. Whether through astute financial analysis, strategic decision-making, or pioneering investment strategies, recipients of this award have made significant contributions to the growth, success, and sustainability of investment portfolios and funds.

Criteria for consideration

Investment Performance: Demonstrated track record of consistently achieving superior returns relative to benchmarks and peers.

Innovation: Introduction of innovative investment strategies, techniques, or products that have reshaped industry practices or led to significant improvements in risk-adjusted returns.

Risk Management: Implementation of effective risk management practices that have mitigated downside risk while maximizing upside potential.

Client Satisfaction: Exemplary client service, communication, and relationship management, resulting in high levels of satisfaction and trust among investors.

Thought Leadership: Contribution to the advancement of investment knowledge and industry best practices through research, publications, or participation in professional organisations.

Ethical Conduct: Commitment to upholding the highest ethical standards and fiduciary responsibilities in investment management.

Long-Term Impact: Evidence of sustainable, long-term value creation for investors and stakeholders, beyond short-term financial gains.

Recipients of the WiBF Award for Achievement in Investment and Fund Management serve as role models for excellence in the financial industry, inspiring others to strive for continuous improvement and innovation in investment practices. This award not only celebrates past achievements but also serves as an encouragement for ongoing dedication to excellence in the management of investment funds and assets while advocating for gender diversity and inclusion in the industry.”

“This distinguished award celebrates individuals or entities that have demonstrated exceptional expertise, innovation, and dedication in the management and stewardship of private wealth and superannuation funds. It recognises outstanding contributions to the financial well-being and prosperity of individuals, families, and retirees through tailored wealth management solutions and strategic planning for retirement with an emphasis on supporting gender diversity & inclusion.

Criteria for consideration:

Client-centric Approach: Evidence of a personalised, client-focused approach to wealth management, ensuring alignment with the unique goals, preferences, and circumstances of private clients and retirees.

Investment Performance: Consistent delivery of superior investment results, via robust risk-adjusted returns and effective wealth preservation strategies over the long term.

Holistic Financial Planning: Provision of comprehensive financial planning services encompassing investment management, retirement planning, tax optimization, estate planning, and risk management to support clients’ financial well-being across multiple life stages.

Innovation and Adaptability: Introduction of innovative solutions, products, or strategies that address evolving client needs, regulatory changes, and market dynamics within the private wealth and superannuation sectors.

Client Education and Empowerment: Commitment to educating clients about financial literacy, investment principles, retirement planning strategies, and superannuation options, empowering them to make informed decisions about their financial futures.

Ethical Standards: Adherence to the highest ethical standards and fiduciary responsibilities, prioritizing the best interests of clients and retirees in all aspects of wealth management and superannuation fund administration.

Industry Leadership and Advocacy: Active engagement in industry advocacy, thought leadership initiatives, and professional development activities aimed at advancing best practices, promoting gender diversity & inclusion, regulatory reforms, and enhancing the integrity and transparency of the private wealth and superannuation sectors.

Recipients of the WiBF Award for Achievement in Private Wealth and Superannuation exemplify excellence, integrity, and innovation in the management of wealth and retirement assets, enriching the lives of clients and contributing to the overall financial well-being and prosperity of society. This award honours their outstanding achievements and serves as a testament to their commitment to excellence in private wealth management and retirement planning while advocating for gender diversity and inclusion in the industry.”

“This prestigious award celebrates outstanding professionals in the field of retail banking. It honours financial institutions that have demonstrated exceptional performance, customer service, and strategic vision in serving retail customers.

Criteria for consideration:

Customer Satisfaction: The recipient institution must have a track record of delivering exceptional customer experiences, as evidenced by high satisfaction ratings and positive feedback from retail banking clients.

Innovation: Successful implementation of innovative products, services, or technologies that enhance the retail banking experience and address evolving customer needs and preferences.

Financial Performance: Demonstrated strong financial performance, including growth in retail banking revenue, profitability, and market share, while effectively managing risk and maintaining regulatory compliance.

Digital Transformation: Adoption of digital platforms and technologies to streamline processes, improve accessibility, and provide personalized banking services to retail customers.

Community Engagement: Active involvement in community initiatives and social responsibility programs that contribute to the well-being of the communities served by the institution.

Leadership and Vision: Demonstrated leadership and strategic vision in navigating industry challenges, adapting to market trends, and positioning the institution for long-term success in the retail banking sector.

The recipient of this WiBF award is a trailblazer in the retail banking industry, setting benchmarks for excellence and serving as a role model for other financial institutions striving to deliver exceptional value to retail customers while advocating for gender diversity and inclusion in the industry.”

“This esteemed award celebrates exemplary achievements and contributions of amazing individuals within the realm of SME and business banking. It acknowledges individuals of financial institutions (with less than $500M in revenue) that have demonstrated exceptional performance, innovation, and dedication in meeting the unique needs of businesses, both small and large with a focus on gender diversity & inclusion along the way.

Key criteria considered:

Customer Satisfaction: The recipient institution must exhibit a commitment to providing superior service and support to business clients, as evidenced by high levels of customer satisfaction and positive feedback.

Tailored Solutions: Recognition of innovative products, services, and solutions specifically designed to meet the diverse needs of businesses, including financing options, cash management tools, and specialized advisory services.

Relationship Management: Demonstrated excellence in building and nurturing long-term relationships with business clients, offering personalized guidance, and understanding their evolving needs to provide tailored solutions.

Financial Performance: Consistent financial strength and growth in business banking revenue, profitability, and market share, coupled with effective risk management practices and adherence to regulatory requirements.

Technology and Digital Solutions: Implementation of cutting-edge technology and digital platforms to streamline processes, enhance convenience, and provide businesses with efficient banking solutions.

Community Impact: Active engagement in supporting local businesses and contributing to the economic development and prosperity of the communities served by the institution.

Thought Leadership: Demonstrated leadership and vision in anticipating market trends, adapting to industry changes, and providing thought leadership on key issues affecting business banking.

The recipient of this WiBF award exemplifies excellence in business banking, setting industry standards for innovation, customer service, and overall performance while making significant contributions to the success and growth of businesses in their community to support gender diversity & inclusion and beyond.”

“This distinguished award celebrates outstanding achievements and excellence of professionals in the field of institutional. corporate and investment banking. It celebrates an individual from a financial institution that has demonstrated exceptional performance, innovation, and commitment to meeting the complex needs of institutional clients, including corporations, government entities, and non-profit organisations while keeping gender diversity and inclusion top of mind.

The criteria for this award:

Customer Satisfaction: The recipient institution must exhibit a strong dedication to providing exceptional service and support to institutional clients, as evidenced by high levels of client satisfaction, feedback, and retention.

Tailored Solutions: Recognition of innovative products, services, and solutions tailored to the unique requirements of institutional clients, including corporate finance, treasury management, capital markets, and risk management solutions.

Relationship Management: Demonstrated excellence in building and maintaining long-term relationships with institutional clients, offering personalised advisory services, and understanding their specific financial objectives and challenges.

Financial Performance: Consistent financial strength and growth in institutional banking revenue, profitability, and market share, while effectively managing risks and ensuring compliance with regulatory standards.

Technology and Digital Solutions: Implementation of advanced technology and digital platforms to enhance efficiency, provide real-time access to financial information, and deliver seamless banking experiences to institutional clients.

Thought Leadership: Demonstrated leadership and expertise in providing strategic insights, thought leadership, and market intelligence to institutional clients, helping them navigate complex financial landscapes and achieve their goals.

Community Engagement: Active involvement in supporting community initiatives, fostering gender diversity and inclusion, economic development, and contributing to the well-being of the communities served by the institution.

The recipient of this WiBF award represents the pinnacle of excellence in institutional banking, setting industry benchmarks for innovation, service quality, and overall performance while making significant contributions to the success and growth of institutional clients and the broader financial ecosystem.”

“This prestigious award celebrates outstanding achievements and leadership in the field of regulation and compliance within the financial services industry. It honors individuals, organisations, or regulatory bodies that have demonstrated excellence, innovation, and commitment to upholding regulatory standards, ensuring compliance, and fostering a culture of integrity and transparency while keeping gender diversity and inclusion top of mind.

Key criteria considered for this award:

Regulatory Compliance Excellence: Demonstrated commitment to upholding regulatory requirements and standards, including adherence to laws, regulations, and industry best practices relevant to the financial services sector.

Innovation in Compliance Practices: Recognition of innovative approaches, tools, and methodologies adopted to enhance regulatory compliance processes, mitigate risks, and ensure effective governance within the organisation or across the industry.

Thought Leadership: Leadership and expertise in shaping regulatory policies, advocating for industry reforms, and providing thought leadership on emerging regulatory trends, challenges, and opportunities.

Proactive Risk Management: Implementation of robust risk management frameworks, controls, and monitoring mechanisms to identify, assess, and mitigate regulatory risks effectively.

Collaboration and Engagement: Collaboration with regulatory authorities, industry peers, and stakeholders to promote dialogue, share insights, and contribute to the development of regulatory standards and practices that benefit the financial ecosystem.

Training and Education: Commitment to providing comprehensive training, education, and resources to employees and stakeholders to ensure a deep understanding of regulatory requirements and foster a culture of compliance and ethical conduct.

Ethical Leadership: Demonstration of ethical leadership, transparency, and accountability in managing regulatory and compliance matters, promoting a culture of integrity and responsible business practices.

Impact on Industry and Society: Positive impact on the financial services industry and society at large through contributions to enhancing regulatory effectiveness, protecting consumers, and promoting financial stability and inclusion.

The recipient of this WiBF award exemplifies excellence in regulation and compliance, serving as a role model for the industry and making significant contributions to maintaining trust, stability, and integrity in the financial services sector.”

“This prestigious award celebrates outstanding achievements and leadership in the realm of professional services. Some common examples of professional services include: Legal Services, Accounting and Auditing Services, Consulting Services, Financial Advisory Services, Human Resources Consulting, Information Technology (IT) Services. It honors individuals, firms, or organisations that have demonstrated exceptional performance, innovation, and dedication in delivering high-quality professional services to clients across various industries.

Key criteria considered for this award:

Client Satisfaction: Demonstrated commitment to exceeding client expectations and delivering exceptional value through tailored solutions, responsive service, and strong client relationships.

Service Excellence: Recognition of superior service delivery, expertise, and innovation across a range of professional services, including consulting, legal, accounting, financial advisory, and technology services.

Innovation and Thought Leadership: Leadership in driving innovation, thought leadership, and best practices within the professional services industry, including the development of new service offerings, methodologies, and approaches to solving client challenges.

Industry Impact: Positive impact on clients, industries, and communities through contributions to driving business growth, fostering innovation, and addressing complex challenges with integrity and professionalism.

Talent Development: Commitment to investing in talent development, mentorship, and diversity initiatives to attract, retain, and develop top talent within the organisation and the broader professional services sector.

Collaboration and Partnerships: Collaboration with clients, industry partners, and stakeholders to foster strategic partnerships, share insights, and deliver integrated solutions that address clients’ evolving needs and drive positive outcomes.

Ethical Standards: Adherence to high ethical standards, transparency, and integrity in all aspects of service delivery, ensuring trust, accountability, and credibility with clients, regulators, and the public.

Continuous Improvement: Commitment to continuous improvement and excellence through ongoing learning, feedback mechanisms, and performance measurement, driving a culture of innovation and excellence within the organisation.

The recipient of this WiBF award exemplifies excellence in professional services, setting industry benchmarks for service quality, innovation, and client satisfaction while making significant contributions to the success and growth of clients, industries, and communities served.”

“This esteemed award celebrates outstanding achievements and leadership in the areas of operations, technology, or customer support within the realm of business and industry. It honors individuals, teams, or organisations that have demonstrated exceptional performance, innovation, and dedication in driving operational excellence, leveraging technology to enhance efficiency and effectiveness, and delivering superior customer support experiences while keeping gender diversity & inclusion top of mind.

Key criteria considered for this award:

Operational Excellence: Demonstrated excellence in optimising business operations, processes, and workflows to improve efficiency, reduce costs, and enhance overall performance. This may include initiatives focused on supply chain management, logistics, production, quality control, and process automation.

Technological Innovation: Recognition of innovative use of technology to drive business transformation, enhance productivity, and enable strategic growth. This may include the development and implementation of new software solutions, digital platforms, data analytics tools, artificial intelligence, or Internet of Things (IoT) applications.

Customer Support Excellence: Commitment to delivering exceptional customer support experiences, responsiveness, and satisfaction. This may include initiatives focused on customer service training, multichannel support options, self-service portals, and proactive customer engagement strategies.

Impact on Business Performance: Positive impact on business performance, profitability, and competitiveness through the implementation of operations, technology, or customer support initiatives. This may be demonstrated through measurable improvements in key performance indicators such as cost savings, revenue growth, customer retention, and employee satisfaction.

Collaboration and Teamwork: Collaboration across departments, teams, and stakeholders to drive alignment, foster innovation, and achieve shared goals related to operations, technology, or customer support excellence.

Continuous Improvement: Commitment to continuous learning, feedback, and improvement in operations, technology, and customer support practices. This may include a culture of innovation, experimentation, and agility to adapt to changing business needs and market dynamics.

Ethical Standards: Adherence to high ethical standards, transparency, and integrity in all aspects of operations, technology, and customer support activities, ensuring trust, accountability, and credibility with customers, employees, and partners.

The recipient of this WiBF award exemplifies excellence in operations, technology, or customer support, serving as a role model for the industry and making significant contributions to driving business success, innovation, and customer satisfaction.”

“This prestigious award celebrates exemplary achievements and leadership in the field of corporate affairs. It honors individuals, teams, or organisations that have demonstrated outstanding performance, innovation, and dedication in managing corporate communications, public relations, government affairs, and stakeholder engagement. Teams and individuals from Corporate & Internal Communications, Brand & Marketing, Investor Relations, Corporate Social Responsibility department are eligible to apply in this category.

Key criteria considered for this award:

Strategic Communications: Demonstrated excellence in developing and executing strategic communication strategies that effectively convey the organisation’s mission, values, and objectives to internal and external stakeholders.

Reputation Management: Proven ability to protect and enhance the organisation’s reputation through proactive reputation management strategies, crisis communication planning, and effective stakeholder engagement.

Stakeholder Engagement: Commitment to building and maintaining positive relationships with key stakeholders, including employees, customers, investors, regulators, community members, and advocacy groups.

Government Affairs: Expertise in navigating regulatory and legislative environments, advocating for the organisation’s interests, and engaging with government officials and policymakers to shape public policy outcomes.

Corporate Social Responsibility (CSR): Leadership in corporate social responsibility initiatives, sustainability efforts, and community engagement programs that contribute to the organisation’s positive impact on society and the environment.

Thought Leadership: Recognition as a thought leader in corporate affairs, with contributions to industry best practices, innovation, and thought leadership initiatives that advance the field.

Crisis Management: Demonstrated ability to effectively manage crises and issues, maintain transparency, and uphold trust and credibility with stakeholders during challenging times.

Collaboration and Teamwork: Collaboration across departments and teams to align corporate affairs efforts with overall business objectives and foster a culture of communication, transparency, and accountability.

Measurement and Evaluation: Implementation of robust measurement and evaluation processes to assess the impact of corporate affairs activities, track key performance indicators, and drive continuous improvement.

Ethical Standards: Adherence to high ethical standards, transparency, and integrity in all corporate affairs activities, ensuring trust, credibility, and accountability with stakeholders.

The recipient of this WiBF award exemplifies excellence in corporate affairs, serving as a role model for the industry and making significant contributions to the organisation’s reputation, stakeholder relationships, and overall success.”

“This prestigious award celebrates the professionals who are dedicated to facilitating smooth operations and driving success in the business world. Recipients of this award typically demonstrate exceptional organisational abilities, strong communication skills, efficiency in managing tasks, and a proactive approach to their role. They may also show leadership qualities, problem-solving abilities, and a commitment to continuous improvement.

Key Criteria:

Exceptional Organisational Skills: The recipient should demonstrate the ability to efficiently manage multiple tasks, schedules, and priorities in a fast-paced environment. This includes effective calendar management, travel arrangements, and event coordination.

Effective Communication: Strong written and verbal communication skills are essential. The recipient should be adept at liaising with executives, colleagues, clients, and external partners, demonstrating professionalism and clarity in all interactions.

Proactivity and Initiative: Successful candidates are proactive in anticipating needs and addressing challenges before they arise. They take initiative to streamline processes, suggest improvements, and contribute to the overall efficiency of the organisation.

Problem-solving Abilities: The recipient should exhibit the capacity to identify issues, find creative solutions, and handle unexpected situations with composure and resourcefulness. This may involve resolving conflicts, troubleshooting technical issues, or adapting to changing circumstances.

Adaptability and Flexibility: In a dynamic work environment, adaptability is crucial. The recipient should demonstrate flexibility in responding to shifting priorities, tight deadlines, and evolving requirements, while maintaining a high standard of performance.

Professionalism and Discretion: As a trusted support to executives, the recipient must exhibit professionalism, integrity, and discretion in handling confidential information, sensitive matters, and interpersonal relationships.

Commitment to Continuous Improvement: A dedication to personal and professional development is valued. The recipient should show a willingness to learn new skills, pursue further education or training opportunities, and stay updated on industry trends and best practices.

Contributions to Team Success: While the role may be primarily supportive, the recipient should actively contribute to the success of the team and the organisation as a whole. This may involve collaborating with colleagues, sharing knowledge and expertise, and fostering a positive work culture.

By demonstrating excellence in these key criteria, candidates stand out as deserving recipients of the WiBF Award for Achievement in an EA/PA role, reflecting their significant contributions to their organisations and the broader banking and finance community.”

“This award celebrates an individual who has made an outstanding contribution in leading the innovation agenda in the Banking and Finance industry in Australia, either through thought leadership, product development, technical expertise or as an innovator. The winner of this award will demonstrate a passion towards innovation in their workplace and a commitment to the long-term sustainability of the sector.

Key criteria:

Novelty and Originality: Recognition of the uniqueness and originality of the product or technology innovation, including the development of new concepts, features, or functionalities that differentiate it from existing solutions.

Impact and Value Proposition: Assessment of the tangible benefits and value delivered by the innovation, such as improved efficiency, effectiveness, performance, cost savings, or customer satisfaction. Consideration may also be given to the broader societal or environmental impact of the innovation.

Technical Excellence: Evaluation of the technical excellence and sophistication of the innovation, including the use of advanced technologies, engineering principles, or scientific breakthroughs to achieve desired outcomes.

Market Relevance and Competitiveness: Consideration of the innovation’s relevance and competitiveness in the marketplace, including its ability to address customer needs, meet industry standards, and adapt to changing market dynamics.

User Experience and Accessibility: Assessment of the user experience and accessibility of the innovation, including ease of use, user interface design, and accessibility features that enhance usability and inclusivity.

Scalability and Sustainability: Consideration of the scalability and sustainability of the innovation, including its potential for widespread adoption, scalability to meet growing demand, and long-term viability in terms of resource efficiency and environmental impact.

Collaboration and Teamwork: Recognition of collaborative efforts and teamwork involved in the development and implementation of the innovation, including contributions from cross-functional teams, partnerships with external stakeholders, and cooperation across organisational boundaries.

Intellectual Property and Protection: Assessment of intellectual property rights and protection mechanisms associated with the innovation, including patents, trademarks, copyrights, or trade secrets that safeguard the innovation’s competitive advantage and prevent unauthorised use or replication.

Adaptability and Flexibility: Consideration of the innovation’s adaptability and flexibility to evolve over time in response to changing requirements, technological advancements, or market demands, ensuring its continued relevance and competitiveness.

Recognition and Awards: Recognition of previous accolades, awards, or industry recognition received for the innovation, demonstrating its impact and recognition by peers, customers, or industry experts.

This WiBF Award celebrates individuals, teams, or organisations that push the boundaries of creativity and excellence in product development and technical innovation, driving positive change and shaping the future of the banking and finance industry.”

“This award celebrates someone in the early stages of their career (less than 5 years experience) who is making an exceptional impact within a Corporate Member organisation of WiBF. The winner of this award will be outperforming her peers across the industry in terms of their role performance and in the encouragement they provide to colleagues. They will demonstrate passion and commitment towards their career in the banking and finance sector and be an example of the values and performance necessary for the future success of the Banking and Finance industry.

Key criteria:

Achievements and Contributions: Recognition of significant accomplishments and contributions made by the individual in their respective field, industry, or community, despite being relatively early in their career.

Innovation and Creativity: Acknowledgment of innovative thinking, creative problem-solving, and original ideas demonstrated by the individual, showing their ability to think outside the box and bring fresh perspectives to their work.

Leadership Potential: Assessment of leadership potential, including the ability to inspire and motivate others, demonstrate initiative, and take on responsibilities beyond their current role or position.

Professional Growth and Development: Evaluation of the individual’s commitment to continuous learning, professional development, and skill enhancement, as evidenced by their willingness to seek out new opportunities, acquire new knowledge, and expand their expertise.

Resilience and Adaptability: Consideration of resilience, adaptability, and the ability to overcome challenges and setbacks, demonstrating a positive attitude, perseverance, and a growth mindset in the face of adversity.

Impact and Influence: Assessment of the individual’s impact and influence within their organisation, industry, or community, including their ability to effect positive change, inspire others, and make a difference through their actions and contributions.

Collaboration and Teamwork: Recognition of collaboration and teamwork skills demonstrated by the individual, including their ability to work effectively with others, build strong relationships, and contribute to collective goals and objectives.

Potential for Future Success: Consideration of the individual’s potential for future success and growth, based on their demonstrated capabilities, performance, and trajectory early in their career or endeavours.

Community Engagement and Service: Acknowledgment of the individual’s involvement in community service, volunteer work, or other activities that contribute to the betterment of society and demonstrate their commitment to making a positive impact beyond their professional endeavours.

Peer Recognition and Recommendations: Input from peers, mentors, supervisors, or other stakeholders who can attest to the individual’s talents, potential, and contributions, providing additional evidence of their deservingness of the Rising Star Award.

This WiBF Award celebrates individuals who show exceptional promise, talent, and potential early in their careers, recognising their achievements, leadership qualities, and commitment to growth and excellence. It serves as encouragement and motivation for continued success and contributions in the banking and finance industry.”

“This award celebrates a WiBF Corporate member that leads by example, who goes above and beyond to create environments where people from diverse backgrounds feel valued, respected, and empowered. Inclusive leaders demonstrate empathy, open-mindedness, authenticity, courage, collaboration, resilience, continuous learning, accountability, allyship and adaptability.

Key Criteria Considered for this award:

Commitment to Diversity and Inclusion: Demonstrated efforts to foster diversity and inclusion within the organisation or community, including initiatives to recruit, retain, and promote individuals from underrepresented groups.

Leadership and Advocacy: Active advocacy for diversity and inclusion both internally and externally, using their platform to promote awareness and drive positive change.

Innovative Practices: Implementation of innovative strategies, programs, or policies that promote diversity, equity, and inclusion and address systemic barriers.

Measurable Impact: Evidence of tangible outcomes or positive changes resulting from their leadership efforts, such as increased representation of marginalised groups, improved employee satisfaction and engagement, or enhanced community relations.

Collaboration and Engagement: Collaboration with stakeholders across different levels of the organisation or community to build consensus, foster dialogue, and create inclusive environments where diverse perspectives are valued.

Continuous Learning and Improvement: Demonstrated commitment to ongoing learning, self-reflection, and improvement in the area of diversity and inclusion, including responsiveness to feedback and willingness to adapt strategies as needed.

This WiBF award celebrates those who thrive and lead the way in creating more equitable and inclusive societies. They also serve as important catalysts for inspiring others to take action and prioritise diversity and inclusion in their own spheres of influence within the banking and finance community.”

“This award celebrates a Corporate Member organisation of WiBF for a workplace initiative that has delivered a tangible impact in addressing gender diversity in the banking and finance sector. This award celebrates a WiBF Corporate member who demonstrates unique processes that encourage and enable gender diversity and inclusion in their workplace. The Inclusive Workplace Award celebrate organisations that demonstrate exceptional commitment to fostering diversity, equity, and inclusion (DEI) within their workforce. This award celebrates companies that go above and beyond in creating environments where employees from diverse backgrounds feel valued, respected, and supported.

Criteria for the award:

Diversity Initiatives: The organisation’s efforts to recruit and retain employees from diverse backgrounds, including underrepresented groups such as minorities, women, LGBTQ+ individuals, people with disabilities, and others.

Inclusive Policies and Practices: Assessment of company policies and practices to ensure they are inclusive and equitable. This may include anti-discrimination policies, flexible work arrangements, equal opportunities for advancement, and accommodations for employees with disabilities.

Training and Education: Programs aimed at raising awareness and educating employees about diversity, equity, and inclusion issues, as well as providing tools and resources for fostering inclusive behaviours and combating biases.

Leadership Commitment: Demonstrated commitment from company leadership to diversity, equity, and inclusion, including accountability measures and allocation of resources to support DEI initiatives.

Employee Resource Groups (ERGs) or Affinity Groups: Recognition of ERGs or affinity groups within the organisation that provide support, networking, and advocacy opportunities for employees from specific demographic or identity groups.

Community Engagement: Initiatives aimed at promoting diversity and inclusion beyond the workplace, such as partnerships with community organisations, participation in diversity-focused events, and advocacy for social justice causes.

Measurement and Reporting: Methods for measuring progress towards diversity and inclusion goals, as well as transparency in reporting on DEI metrics and outcomes.

Organisations that excel in these areas and demonstrate a genuine commitment to creating long term inclusive workplaces will be strong contenders for the WiBF Inclusive Workplace Award. This recognition not only showcases their achievements but also serves as a benchmark for other companies to strive towards greater diversity, equity, and inclusion.”

“This award recognises a Corporate Member organisation of WiBF for an ESG initiative that demonstrates an innovative and impactful approach to improving business sustainability and social responsibility. Judges will look for the ESG initiative that stands out from the competition and could inspire industry-wide change.

Criteria for the Award:

Innovative Practices: Recognition of innovative strategies, programs, or initiatives implemented to address environmental challenges, promote social responsibility, and enhance corporate governance.

Impact and Results: Assessment of the measurable impact and outcomes achieved through ESG and sustainability initiatives, such as reductions in carbon emissions, improvements in social equity, and enhancements in governance transparency and accountability.

Leadership and Vision: Acknowledgment of leadership and vision in championing ESG and sustainability within the organisation or industry, including commitment from senior executives, board members, and key stakeholders.

Integration and Alignment: Evaluation of the extent to which ESG considerations are integrated into business strategies, decision-making processes, and day-to-day operations, ensuring alignment between financial performance and sustainable practices.

Transparency and Reporting: Recognition of transparent disclosure and reporting practices regarding ESG performance, including the quality and comprehensiveness of sustainability reports, adherence to global reporting standards (such as GRI or SASB), and engagement with stakeholders.

Stakeholder Engagement: Consideration of efforts to engage and collaborate with stakeholders, including investors, customers, employees, suppliers, communities, and NGOs, to address ESG issues and priorities effectively.

Continuous Improvement: Assessment of a commitment to continuous improvement and learning in the area of ESG and sustainability, including responsiveness to feedback, adoption of best practices, and setting ambitious goals for future progress.

Industry Leadership: Recognition of leadership within the industry or sector, inspiring others to adopt ESG and sustainability best practices and driving positive change across the value chain.

Resilience and Adaptability: Consideration of resilience and adaptability in addressing emerging environmental and social challenges, as well as proactive risk management strategies to mitigate potential ESG-related risks.

Long-Term Perspective: Emphasis on the long-term perspective and sustainable value creation, demonstrating a commitment to addressing systemic issues and contributing to a more sustainable and equitable future for society and the planet.

This Award will celebrate organisations and individuals that demonstrate exemplary leadership, innovation, and impact in advancing ESG principles and sustainability practices, serving as role models and catalysts for positive change within the banking and finance industry.”

“This esteemed award celebrates outstanding mentorship and leadership in guiding and nurturing individuals to achieve their full potential. It honours individuals who have demonstrated exceptional dedication, support, and inspiration in mentoring others, making a significant and positive impact on their personal and professional growth.

Key criteria for consideration:

Mentorship Impact: Demonstrated impact in positively influencing the personal and professional development of mentees, helping them overcome challenges, develop new skills, and achieve their goals.

Commitment and Dedication: Consistent dedication and commitment to mentoring, including investing time, effort, and resources to support mentees and help them succeed.

Leadership and Guidance: Providing mentorship through effective leadership, guidance, and role modelling, inspiring mentees to reach their full potential and become strong leaders.

Empowerment and Support: Creating a supportive and empowering environment that encourages mentees to take risks, learn from failures, and grow both personally and professionally.

Inspirational Role Model: Serving as an inspirational role model for mentees, demonstrating integrity, resilience, and a passion for continuous learning and growth.

Impact on Diversity and Inclusion: Promoting diversity, equity, and inclusion through mentorship, fostering a culture of belonging and empowerment for individuals from diverse backgrounds.

Long-Term Relationship Building: Building strong and lasting relationships with mentees, providing ongoing support and guidance beyond the formal mentoring relationship.

Contributions to the Community: Engaging in mentorship activities that extend beyond the workplace, such as volunteering, community outreach, or mentorship programs in educational institutions or professional associations.

The recipient of the Mentor of the Year award exemplifies excellence in mentorship, embodying the qualities of leadership, guidance, and support that inspire others to realize their full potential and achieve success in their personal and professional lives.”

Watch the below video to learn how to craft an award winning nomination!

FAQs

Yes. You must be a current financial member of WiBF or an employee of a WiBF Corporate Member. You can become a member at anytime: Individual memberships

The WiBF Awards Program is open to all members of WiBF. Award nominees must be a current financial member of WiBF or an employee of a WiBF Corporate Member. WiBF represents 600,000+ individuals across Australia with 90+ Corporate Members, 60+ of which have international offices, servicing 32 countries. Although everyone is welcome to submit a nomination, the judges will be looking for individuals and initiatives that are making a tangible impact primarily in Australia.

No. The Award nominee doesn’t have to work in your organisation. You can nominate an individual from the broader financial services industry, but they must work for a current WiBF Corporate Member or be an Individual member.

The list of current WiBF Corporate Members is located on the membership page of our website.

Yes. You can nominate as many colleagues as you wish in each category. You can nominate colleagues in every category as well as a company initiatives.

The nominee’s name should be the individual (or one of if there are multiple) who is the project or initiative lead. Part of our judging process is to contact the shortlisted finalists, so having that point person named on the nomination will make the process more seamless.

Yes. Tickets are available to purchase on the Member Dashboard. Last year this event sold out quickly. Book your tickets today.

Yes, all WiBF Corporate Member employees, even those working overseas, can be considered for the WiBF awards as long as they can demonstrate a positive and direct impact on the banking and finance industry in Australia. Applicants should focus on areas where their work has directly influenced or improved aspects of the Australian banking and finance industry. This may include innovations in fintech, regulatory compliance, risk management, sustainable finance, or any other relevant sector-specific initiatives.

Acceptable evidence may include but is not limited to:

- Quantifiable metrics such as increased revenue, cost savings, or market share gains attributable to the applicant’s work.

- Testimonials or endorsements from Australian industry professionals attesting to the applicant’s influence or contributions.

- Documentation of partnerships, collaborations, or joint ventures with Australian financial institutions or organisations.

- Reports, publications, or media coverage highlighting the applicant’s role in shaping Australian banking and finance practices or policies.

Judges will evaluate the quality and depth of evidence provided, as well as the significance of the applicant’s contributions in relation to industry challenges and priorities.

Oversea WiBF members should provide detailed evidence of their contributions to initiatives, projects, or advancements directly affecting the Australian banking and finance sector. This could include outlining specific outcomes, collaborations with Australian institutions, or innovations that have influenced practices within the industry.

Yes, references from international colleagues or clients are acceptable, especially if they can directly speak to the applicant’s impact on the Australian banking and finance industry. However, it’s important for applicants to also include references or testimonials from Australian contacts whenever possible to strengthen their case.

Yes, applications can be submitted on behalf of a team or organisation, provided that the applicant can clearly demonstrate their individual contributions and impact within that context. Collaborative efforts that have benefited the Australian banking and finance industry are highly encouraged.

No, there are no nationality or residency restrictions for applicants. As long as the applicant can demonstrate a positive and direct impact on the Australian banking and finance industry, and a WiBF member, they are eligible to apply regardless of their citizenship or current location.

All genders are warmly welcomed and encouraged to apply for these awards. WiBF is committed to fostering an inclusive and diverse community within the banking and finance industry, and we believe that diverse perspectives contribute to innovation and excellence. Regardless of gender identity, all individuals who have made significant contributions to the Australian banking and finance sector are invited to showcase their achievements and apply for these awards. We value and celebrate the diversity of experiences and expertise that each applicant brings to the table. If you have any specific accommodations or needs related to gender inclusivity during the application process, please feel free to reach out to the WiBF team for support. ceo@wibf.org.au

Crafting a winning entry for the WiBF National Industry awards, requires careful planning, showcasing tangible achievements, and effectively communicating your impact. Always provide as much details as possible – data is key. Keep in mind, what you submit is the only material the judges will review and judge you on. Judges are looking for individuals and initiatives that are making a tangible impact primarily in Australia. Here are some steps to make your entry stand out:

- Understand the Criteria: Thoroughly review the award criteria to ensure your entry aligns with the expectations and focus areas of the award. Tailor your submission to highlight how your work directly impacts the Australian banking and finance industry. Provide strong and clear examples for the judges.

- Highlight Tangible Impact: Clearly articulate the specific outcomes and results of your work. Use quantifiable metrics such as revenue growth, cost savings, market share gains, or measurable improvements in processes or performance.

- Demonstrate Innovation: Showcase any innovative approaches, technologies, or strategies you’ve implemented that have advanced the industry or addressed significant challenges. Highlight how your innovation has positively impacted stakeholders and contributed to industry progress. Even better if you can demonstrate a long-term impact.

- Provide Evidence: Support your claims with concrete evidence such as data analytics, case studies, testimonials, or project reports. Provide clear examples of successful initiatives, projects, or collaborations that demonstrate your expertise and influence.

- Demonstrate Leadership and Collaboration: Highlight your leadership skills, whether it’s leading a team, spearheading initiatives, or driving change within your organisation. Also, demonstrate any collaborative efforts with Australian institutions such as WiBF and industry partners that have led to positive outcomes.

- Communicate Clear and Compelling Story: Craft a compelling narrative that effectively communicates your journey, challenges overcome, and the value you bring to the Australian banking and finance sector. Use clear and concise language to convey your message effectively.

- Tailor Your Entry: Adapt your entry to resonate with the specific goals and priorities of the award. Address any unique aspects of working in Australia or overseas and how they have enriched your perspective and contributions to the Australian banking and finance industry.

- Seek Feedback: Before submitting your entry, seek feedback from colleagues, mentors, or industry experts. They can provide valuable insights and help you refine your submission for maximum impact.

- Review and Polish: Thoroughly review your entry for clarity, accuracy, and completeness. Check for any grammatical errors or inconsistencies and ensure your submission presents a polished and professional image. Make sure to detail all relevant factors that the judging panel should take into consideration.

- Supporting Material: WiBF allows you to upload supporting materials such as pictures, sample of projects, previous awards, and even short videos. Take advantage of it. Judges will appreciate you went the extra mile.

- Submit on Time: Be mindful of the submission deadline and ensure you submit your entry well before the cut off date. Avoid last-minute rushes and give yourself ample time to review and make any necessary revisions.

By following these steps and presenting a compelling case that showcases your achievements, innovation, and impact on the Australian banking and finance industry, you can increase your chances of crafting a winning entry for the WiBF National Industry awards.