Clifford Capital takes the plunge with debut Kangaroo

Australian dollars became Clifford Capital’s first funding currency outside US dollars when the issuer printed its first Kangaroo deal, on 23 August. The issuer talks to KangaNews about aspirations in the market that limited only by the issuer’s growing Australian dollar operations, given the scale of oversubscription its debut deal attracted.

Clifford Capital is a commercially run corporation established by the Singapore government 10 years ago. It provides finance solutions for Singapore businesses with a focus on infrastructure projects and the maritime sector. The increasing volume of activity by Singapore companies in Australia created a natural driver for the borrower to diversify its funding sources beyond its existing US dollar issuance by tapping into the Kangaroo market.

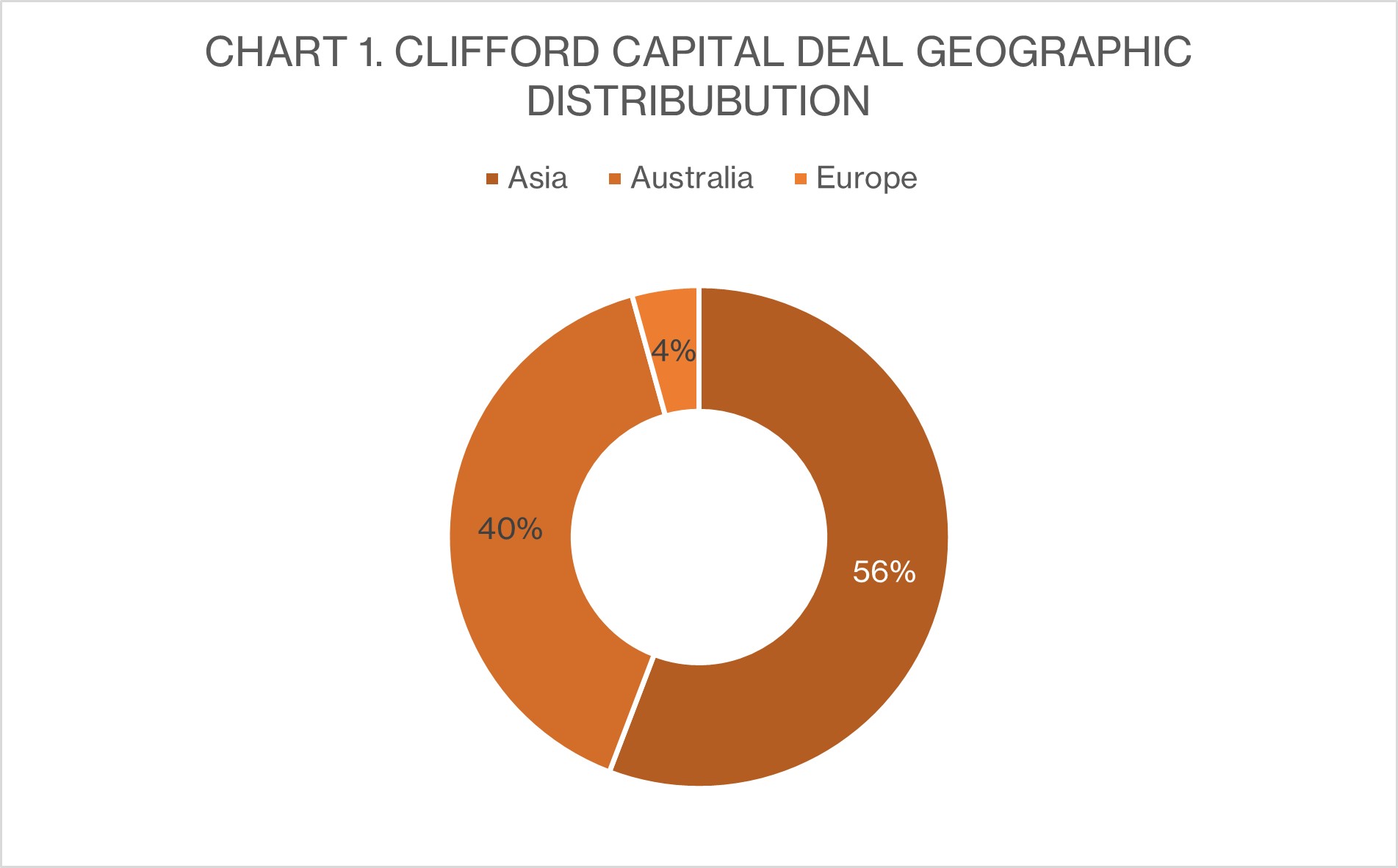

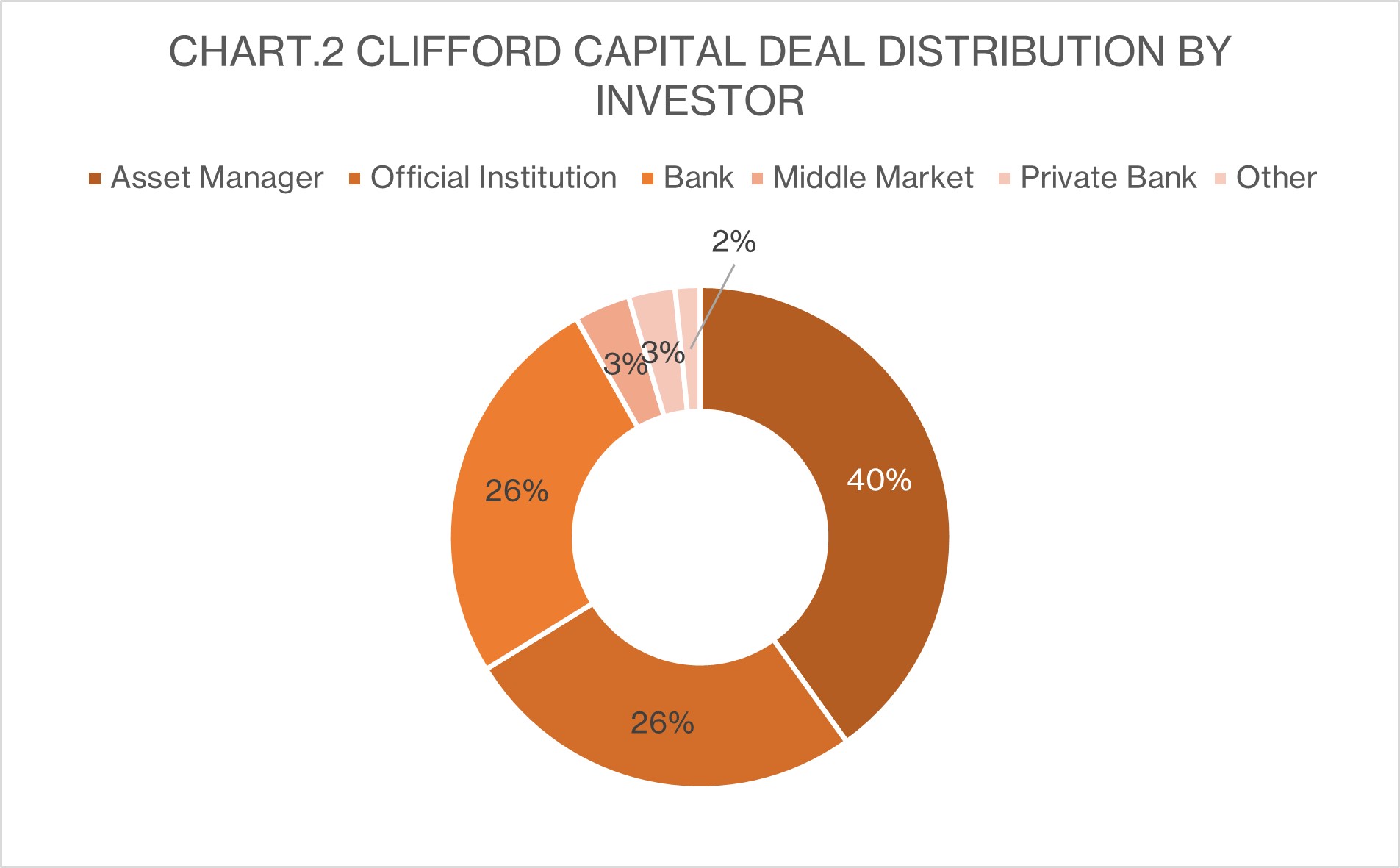

Source: UBS 24 August 2023

Australian dollar funding had been on the Clifford Capital’s watch list for some time and it completed a Kangaroo bond issuance programme in 2021. It now aspires to be a regular issuer in the market, with its frequency and volume of issuance largely to be determined by the growth of its Australian dollar asset book.

The debut transaction attracted a significant oversubscription to what was always set to be a limited issuance volume. The successful bookbuild process presented an opportunity for the transaction to price at 58 basis points over swap, inside the 60-65 basis points initial price guidance.

As Nick Kalisperis, Sydney-based executive director at UBS, points out, such tightening is not common in the Kangaroo supranational, sovereign and agency market. “It was not clear from the outset that we could land the transaction inside the initial price guidance” he comments. “But to be in a position to do so speaks volumes to the strength of the Issuer’s credit, resulting in strong investor appetite and limited attrition. Investors wanted to have this name in their Australian dollar portfolio. ”

Source: UBS 24 August 2023

Deal pricing

Deal pricing

Issuer name: Clifford Capital

Issuer rating: AAA/Aaa/AAA

Issue rating: AAA (S&P)

Pricing date: 23 August 2023

Maturity date: 31 August 2028

Lead managers: ANZ, UBS

Transaction type: senior-unsecured bond

Volume: A$350 million (US$225.6 million)

Volume at launch: benchmark

Coupon: 4.753%

Issue/re-offer price: par

Issue yield: 4.753%

Margin to swap: 58bp/s-q

Margin at launch: 60-65b/s-q

Brenton Smith, Sydney-based director, debt syndicate at ANZ, agrees that the joint lead managers wanted to take a responsible approach to pricing – especially given the margin was already tight to Clifford Capital’s outstanding US dollar debt. He explains: “A number of accounts stood back because initial price thoughts were inside where the issuer’s US dollar curve was trading. While those lines are not particularly liquid, they were still a reference point investors considered.”

Clifford Capital’s funding team spoke to KangaNews about the issuer’s Australian dollar book, how it positioned itself as a comparison with other Kangaroo issuers, execution and its aspirations for future Australian dollar issuance.

What drove the decision for Clifford Capital to come to the Australian dollar market – and why now?

A LOW We have actually been looking at the Australian market for a while, but it wasn’t until a couple of years ago that we had the ability to issue into it. We are a specialist lender, set up with support from the Singapore government to provide cross-border project and structured financing solutions for Singapore-based companies seeking to invest in or export to overseas markets globally.

The support from the Singapore government is by way of a guarantee on all our debt funding requirements. The government guarantee originally only covered US dollar denominated debt, as our lending activities were largely in US dollars. It is only in the last couple of years that we had our suite of currencies expanded to include Australian dollars. This was partly in response to the increasing demand from Singapore-based companies for Australian dollar financing, in tandem with a growing interest in investing in Australia. The ability to fund in Australian dollars gives us a natural hedge and is therefore one of the key drivers of this deal. Having the flexibility to fund in a currency other than the US dollar is also a big draw for us.

Other government-related entities have debuted in the Kangaroo market – specifically Canadian Pension Plan Investment Board (CPPIB) and New Zealand Local Government Funding Agency (LGFA). Did their success influence your thinking about the market?

ONG Our research into the Australian market showed that more than half the issues are from SSA [supranational, sovereign and agency] issuers, and that the market has been extremely active this year. The fact that Clifford Capital’s issuance is fully backed by a government guarantee and is triple-A rated led us to believe the market would be well-suited to our funding requirements.

We looked at the Kangaroo issuance of our SSA peers and noted that, from time to time and depending on the cross-currency swap basis, it can be more attractive than the US dollar market. It therefore made a lot of sense for us to consider the market on the long-term basis from a funding perspective.

What story did Clifford Capital take to investors ahead of the deal and how it was it received?

T LOW Our story has not changed since our inception. We shared what our purpose is and our business mission: to support Singapore-based companies in their internationalisation efforts. What has evolved, though, is the increase in Singapore-based companies coming into Australia. This necessitated us to consider diversifying our funding sources by looking at tapping the Kangaroo market. We found that there was a relatively large investor base with good appetite for paper like ours and that was keen to participate.

We then undertook a lot of groundwork to introduce Australian dollars to our MTN platform, with a specific focus on ensuring that our issuance, if we went ahead with it, would be repo-eligible – as we understand this would meet the needs of investors looking at triple-A paper like ours.

Investor engagement was a meeting of minds in the context of our desire to diversify funding sources and tap more currencies, expand our investor base to support Singapore companies in the Australian dollar market and, from an investor perspective, to ensure our supply met their demand needs regarding repo and yield expectations.

This process culminated in a debut deal where the demand for our paper was really overwhelming. Our final order book was 3.2 times oversubscribed, which is a testament to the scale of demand for high-grade paper and receptivity to our story. I’d like to add that this journey of discovery was facilitated by our joint lead managers, ANZ and UBS, and would like to acknowledge their contribution to this inaugural issuance. They helped us gauge investor demand, set up the necessary meetings and advised on how we should be structuring and pricing this bond.

“Although we were able to swap a small amount of Australian dollars from the deal into US dollars and opportunistically achieve better pricing than our US dollar debt this time, this wasn’t our primary objective – given we have natural demand in Australian dollars. In fact, most of the proceeds are retained in Australian dollar.”

Repo-eligibility is only conferred retrospectively in Australia. Was there any feedback to the effect that some accounts will be prepared to participate once they have seen it demonstrated?

ONG Repo-eligibility is an important criterion that helps deepen the liquidity of bond issues. We understood that the RBA [Reserve Bank of Australia] does not provide in-principle approval but having studied all the conditions and consulted our counsel, we believe we fulfill all the published criteria. I believe the investors would have done their homework and come to the same conclusion.

Furthermore, given the Clifford Capital bond issues are fully backed by the Singapore sovereign and are triple-A rated, I think investors appeared to be prepared to put any residual concerns aside. An orderbook that peaked at close to A$1.5 billion sends a powerful signal about investor demand.

The deal Clifford Capital printed was A$350 million and as you note the book was much bigger – which would have allowed for a more sizeable print. How were volume intentions communicated in advance and during execution?

ONG Our Australian dollar funding requirement was actually a little less than A$300 million but we were prepared to come to market with a well-accepted A$300 million market benchmark size. Given the overwhelming demand, we decided to grow the book to A$350 million and swap a small amount out of Australian dollars.

Our main consideration was that this is not going to be a one-time issue. We intend to come back to the market and have a more regular presence rather than doing mega-sized transactions and disappearing for an extended period.

During the investor engagement and roadshow in Australia we communicated to the investors that we are looking at A$300-350 million in size. We believe investors would have been well aware that we were never planning to print a much larger deal.

How does the cost of funds compare with what else was available to Clifford Capital?

ONG The Kangaroo pricing we achieved is aligned with our expectations. Our aspirations were to compare with LGFA as the most recently priced [new issuer benchmark] transaction in the market and one that went exceptionally well. As you know, the SSA universe is pretty wide. But from a comparable perspective, the key comps we considered were LGFA, CPPI, and, to some extent, Export Development Canada. Our pricing was a few basis points wider than these names – which we believe is the right strategy to engage investors for a debut transaction.

Although we were able to swap a small amount of Australian dollars from the deal into US dollars and opportunistically achieve better pricing than our US dollar debt this time, this wasn’t our primary objective – given we have natural demand in Australian dollars. In fact, most of the proceeds are retained in Australian dollar.

As mentioned earlier, we only added Australian dollars to our funding options two years ago. Until then, we have had to fund our Australian loan portfolio through synthetic sources – which naturally had a higher cost.

What are your aspirations for regularity of issuance? Do you hope to see your Australian dollar pricing tighten over time, as you build a curve?

ONG We are encouraged by the strong reception from investors, domestically and offshore. The establishment of a curve and the timing of subsequent issuance will be subject to our asset funding requirements. This certainly will not be our only transaction – we will come back to the market.

A LOW We are still very much in ramp-up mode on the asset side of our balance sheet. How quickly we return to market in part depends on how quickly we are accumulating Australian dollar denominated assets on balance sheet. For now, we are enjoying some positive momentum.

Based on Clifford Capital’s focus on project finance, it seems there might be some opportunity to go longer in tenor in due course. Meanwhile, are green bonds something you could look at in future?

A LOW We find we can offer longer tenors more readily than banks, which generally gravitate toward the shorter end of the curve. We have certainly found ourselves in situations where we lend at longer tenors in our US dollar loan book, however, we haven't seen this build up as quickly in the Australian dollar book. Once it does, our requirements will obviously also go longer on the funding side.

Because green bonds are a use-of-proceeds type of issuance, they would require us to build up sufficient assets before we can come to market. Therefore, at the moment we are looking more at the possibility of sustainability-linked issuance, which ties in well our own ESG [environmental, social and governance] targets and our overall climate aspirations.

SSA Yearbook 2023

The annual guide to the world's most significant supranational, sovereign and agency sector issuers.