Thinktank

| SIZE OF LOAN BOOK | A$5.4BN | ||

| MAKEUP OF LOAN BOOK |

Commercial mortgages: 34% |

||

| GEOGRAPHIC DISTRIBUTION OF LOAN BOOK |

Australia: 100% |

||

| OUTSTANDING DEBT ISSUANCE |

Term securitisation: A$2.7BN |

||

About Thinktank

Thinktank Group is an independent nonbank financial institution specialising in SME and self-employed finance secured by first registered mortgages over standard commercial and residential property. Established in 2006, Thinktank is wholly Australian owned. It was created and continues to be led by a group of professionals with extensive backgrounds in financial services specifically commercial and residential property, and self-employed and SME finance.

With a focus on the highest standards of corporate governance and compliance, the Thinktank board comprises a mix of the company s founders and independent professional directors, who contribute diversity of experience and multisector disciplines to the growth and direction of the business.

Funding strategy

Thinktank's funding model is predicated on the principles of traditional wholesale warehouse funding and term securitisation. The company completed an inaugural, privately placed CMBS transaction in 2014, which it has followed with successive public deals in 2016 and each year thereafter, culminating in a record A$750 million CMBS transaction in 2021 and A$500 million CMBS transactions in 2022 and 2023.

Thinktank has continued to systematically expand its origination and term funding arrangements with new distribution partners and a progressively wider range of on- and offshore funding partners. In 2021, it completed an inaugural RMBS transaction, with two further deals in 2022 and two more in 2023. Ongoing programmatic issuance is expected. Thinktank's total issuance stands at A$6 billion across 13 transactions (nine CMBS and four RMBS).

Performance history

Through its 17 years of operation, Thinktank has been recognised for its conservative origination approach, leading to consistently low arrears and a negligible loss history through the cycle. With an average loan size of around A$600,000, a weighted LVR of about 66% and fully amortising loans out to 30 years, the characteristics of Thinktank s commercial and residential book have been derived to suit the ideal characteristics of small-ticket CMBS and traditional RMBS issuance.

Underlying CMBS assets comprise a well-balanced mix of standard income producing office, small industrial, retail and mixed-use properties, located in metropolitan and major urban areas across Australia. No specialised or remote securities, vacant land or construction and development property types are permitted. The commercial portfolio is weighted toward standard light industrial properties.

RMBS assets are secured by standard houses and apartments located in metropolitan and other major urban areas, predominantly in the major markets on the eastern seaboard.

Thinktank offers a range of full-documentation and alternative verification loan products. It is also recognised as a market leader in SMSF lending. This business stands out due to its exceptionally low arrears and zero losses over 11 years.

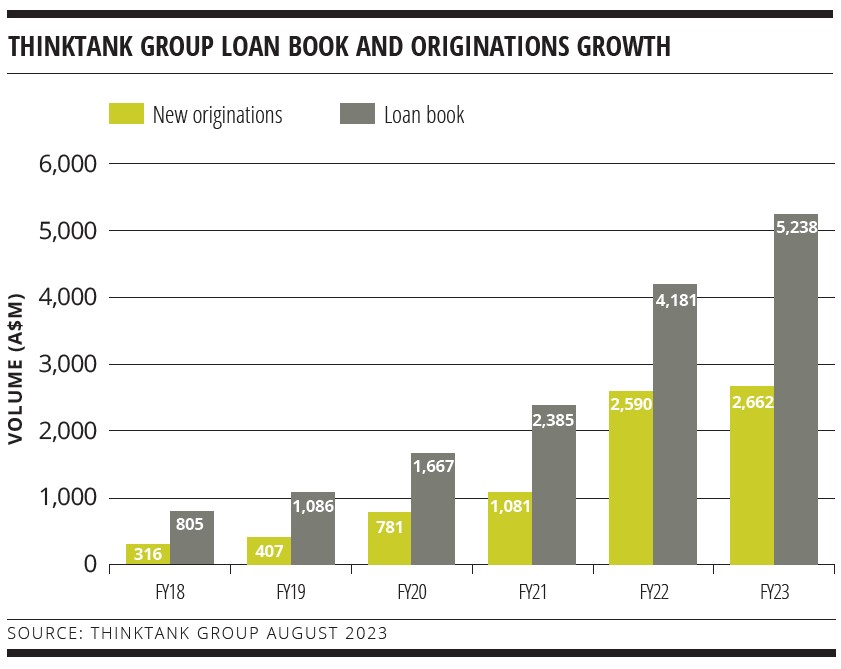

Having originated more than A$9 billion of small-ticket commercial and standard residential loans, Thinktank has established an enviable track record of performance in capital markets while continuing to extend its distribution relationships organically yet strategically.

Weighted-average LVR has continued to trend conservatively over the past five years while prudent credit underwriting standards have been prioritised through the pandemic period and tightening of monetary policy.

The business is also substantially progressed on its digital transformation path, having brought loan servicing in-house in late 2021 within a Salesforce-based end-to-end platform. This has positioned Thinktank ideally for further growth and digital enhancements.

With its portfolio surpassing A$5.4 billion, Thinktank remains focused on further disciplined growth through investing in its relationships at origination and funding levels.

FOR FURTHER INFORMATION PLEASE CONTACT:

Ernest Biasi

Treasurer

+61 2 8000 7885

This email address is being protected from spambots. You need JavaScript enabled to view it.

Cullen Hughes

Chief Financial Officer

+61 2 8669 5518

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.thinktank.net.au

nonbank Yearbook 2023

KangaNews's eighth annual guide to the business and funding trends in Australia's nonbank financial-institution sector.