Diverse Australian securitisation collateral a safe haven as volatility builds

The Australian dollar securitisation market has continued to offer issuance opportunities for originators of a wide range of collateral despite revived rates uncertainty and an uncertain geopolitical backdrop. Recent issuers from outside the prime mortgage sector note ongoing supportive liquidity, improving pricing conditions and a noteworthy level of domestic investor support.

Laurence Davison Head of Content KANGANEWS

Joanna Tipler Staff Writer KANGANEWS

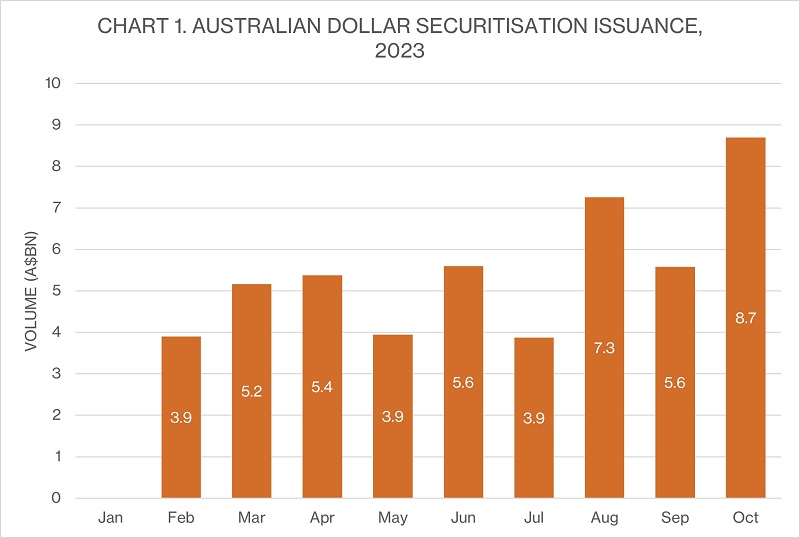

October was the busiest month for new Australian dollar securitisation issuance (see chart 1) in what is already a record year for the asset class: the first deal of November took volume past the A$50 billion (US$32.2 billion) mark, more than any previous full year.

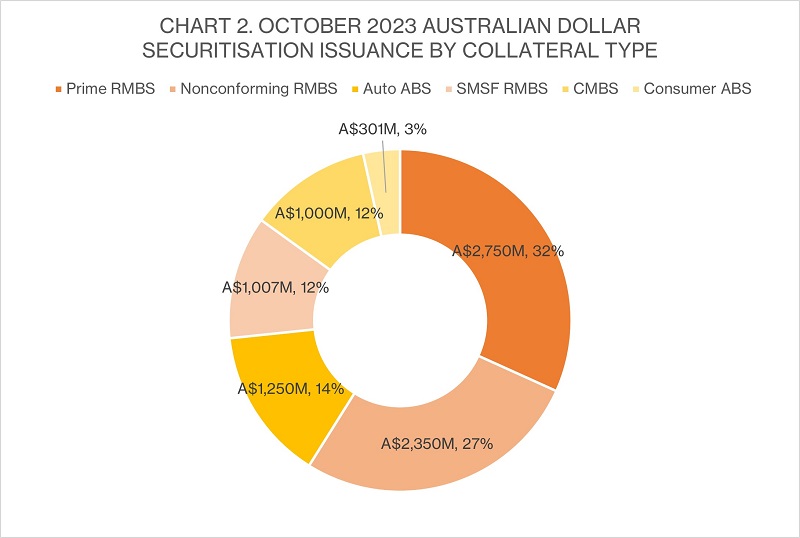

In further positive signs for the asset class, October’s issuance featured a diverse range of collateral while deal flow continued even as the market took on a more cautious tone. Less than one-third of total issuance was prime residential mortgage-backed securities (RMBS) while nonmortgage asset-backed securities (ABS) formed nearly 30 per cent of the total (see chart 2) – a much more diverse makeup of supply than Australian market norms.

Meanwhile, four deals priced for total volume of A$4.6 billion in the last full week of the month despite growing global volatility kicked off by Hamas’s attack on Israel on 7 October and renewed uncertainty about the direction of the cash rate in Australia and globally.

SAFE HAVEN ASSET

Securitisation issuers say the collateral they are offering is increasingly recognised by investors at home and offshore as a sound option even beyond the standard, prime mortgage space and in challenging market conditions. For instance, Angle Auto Finance has now priced two public deals in 2023 – a A$900 million debut in April, and a market return for A$1.25 billion that priced on 26 October – and on both occasions found ample demand despite headwinds.

Steven Mixter, group treasurer at Angle Auto in Sydney, notes that Angle Auto’s debut deal priced shortly after the Silicon Valley Bank and Credit Suisse collapses, while the latest print came to a market rocked by conflict in the Middle East and general volatility in the rates market.

Source: KangaNews 3 November 2023

Source: KangaNews 3 November 2023

Angle Auto’s product offering is relatively appealing in such conditions, Mixter argues. “The market may not have been ideal on either occasion on which we priced this year, but we still managed to achieve great results both times,” he comments. “The collateral we offer is attractive in these types of markets – it is actually something of a safe haven.”

James Austin, chief financial officer at Firstmac in Brisbane, suggests the backdrop may even be beneficial for securitisers. Firstmac printed A$500 million from its Eagle self-managed superannuation fund mortgage programme on 19 October. This is prime collateral, though it typically prices wide of the same issuer’s mainstream prime RMBS programme.

Austin notes that the margin on the latest Eagle deal – 140 basis points over BBSW for the senior notes – is not only competitive with the 130 basis points over BBSW the issuer paid for senior prime issuance from its Firstmac Mortgage Funding Trust programme in August but also significantly tightens the 163 basis points over BBSW margin from the last Eagle deal, priced in March.

Austin says jittery equity markets, the current geopolitical backdrop and rising 10-year rates make the triple-A notes of prime RMBS a safe harbour and a compelling investment given the ongoing performance of Australian mortgage collateral. “Arrears have defied expectations considering the 400 basis point increase in interest rates,” he explains. “There are very few signs of stress anywhere and institutional investors are becoming more comfortable with the outcome of rate increases.”

La Trobe Financial is having the same experience. It priced a A$1 billion nonconforming RMBS on 24 October, and Paul Brown, the issuer’s Melbourne-based treasurer, tells KangaNews: “In light of a number of financial and geopolitical challenges in the market, we have observed progressively stronger demand for our bonds since we priced our first transaction of 2023 in March.”

In this context, the flood of new deal supply provides something of a virtuous circle to prospective issuers rather than stoking fears of buy-side digestion issues. Brown reveals that La Trobe Financial was “encouraged by the number of deals that were being brought to market” as it commenced work on its latest offering, suggesting this implies overall capacity growth.

“Deal flow speaks to the strength of the Australian economy as well as the strong diversification and relative value an Australian issuer can offer to investors domestically and offshore,” Brown claims. “I expect we will continue to experience these trends into 2024, with more investors prepared to explore offerings from Australian securitisation issuers.”

Hummgroup is another issuer to be tempted back to market by positive issuance conditions. It has been an active year for humm in capital markets as it completed a public deal for its flexicommercial book in April, followed by a A$760 million private placement with rated bonds included in August, as well as being active from its Q Card Trust programme in New Zealand with NZ$188 million (US$111.1 million) of bonds issued over the year.

Bianca Spata, Sydney-based group treasurer at humm, tells KangaNews the issuer had been watching the market closely and felt it was an optimal time to also bring its Australian humm consumer portfolio back to market, in a A$301 million transaction. “The market felt increasingly constructive coming into October with positive investor sentiment, liquidity and pricing,” Spata adds. “Despite the unfortunate global events emerging earlier in October, it felt like the right time to push ahead with the trade.”

Spata notes that timing capital markets access is increasingly relevant to optimise investor support and funding costs. “Back in 2021 and even early 2022, the market was particularly positive for issuers from a pricing perspective and timing was less of a factor,” she explains. “It has been pleasing to see spreads tighten over the past few months and the level of demand we received in the latest trade meant we were able to tighten pricing in the mezzanine tranches without reducing investor diversification in the book.”

DIVERSE DEMAND

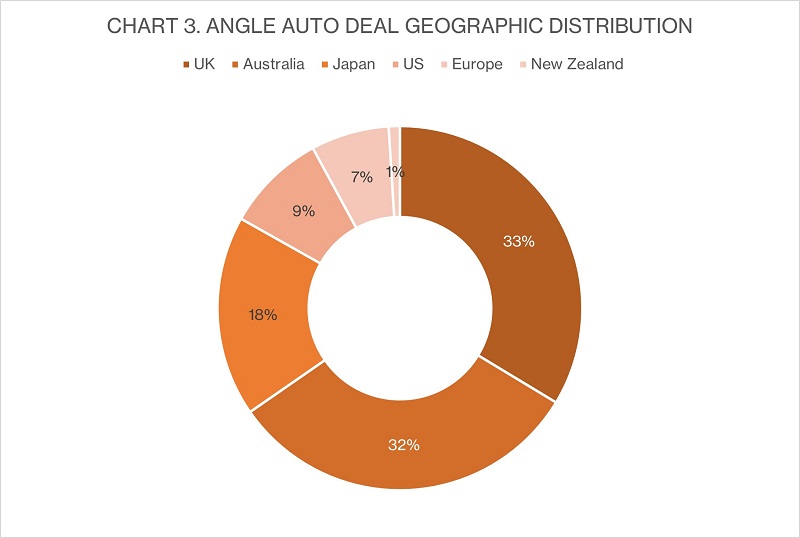

Support for Australian issuance is coming from a diverse investor set. Angle Auto’s deal was sold primarily offshore (see chart 3) but the issuer notes growth in the domestic bid relative to its debut. Distribution to Australian investors increased to around 30 per cent of the latest transaction’s distribution profile from less than 20 per cent in the debut.

Source: KangaNews 3 November 2023

While growing local support was a goal for the issuer, Mixter also notes the ongoing support of UK and Japanese accounts, which took more than half the book between them.

The book was well supported across the capital structure. Mixter says 26 investors participated in the senior notes, including the commission notes, amounting to A$1.5 billion of bids. The mid-mezzanine tranches were particularly sought after, with four-times or greater oversubscription at B and C note level.

Breadth of buy-side interest also expanded significantly. Mixter says the 37 accounts participating in the latest deal were split almost exactly between those that took part in Angle Auto’s debut and new investors to the Panorama programme. The former group represents the bulk of buyers of the debut deal: 18 out of 25 investor names carried over.

By contrast, La Trobe Financial placed its market return exclusively with domestic accounts – the deal “was built around reverse enquiry”, Brown notes – but there was also interest from offshore. The issuer roadshowed in Tokyo and Hong Kong prior to launch.

“Despite the final book being all domestic, we received very strong interest from a number of accounts based in Asia,” Brown reveals. “This included new and existing investors that were willing to engage with issuers early to help build out a transaction. This speaks volumes about the strength of the Australian market and its attractiveness for domestic and international investors.”

The humm deal split the difference between Angle Auto and La Trobe Financial in geographic distribution: 68 per cent of the book went to investors in Australia and New Zealand, Spata says. A total of 15 investors participated including two new names to humm, which Spata highlights as “a particularly positive outcome given the maturity of this programme”.

SUPPLY LINE

Diversity of securitisation collateral reflects the nonbanks sector’s drive to broaden the range of credit it is supplying and growth in the outright number of active nonbanks and their lending strategies. It also facilitates this growth, by demonstrating the availability of capital market debt financing to a range of nonbank names and strategies.

Issuers are generally confident about origination pipeline. Spata says the consumer and SME sectors remain resilient despite continuing caution regarding the macroeconomic outlook and nonbanks continue to write good quality collateral. Books are growing across the nonbanks in alternative asset classes and this volume will ultimately find its way into public markets.

“Deal flow speaks to the strength of the Australian economy as well as the strong diversification and relative value an Australian issuer can offer to investors domestically and offshore. I expect we will continue to experience these trends into 2024, with more investors prepared to explore offerings from Australian securitisation issuers.”

Spata comments: “There is an ongoing need to access markets. We are not alone as an issuer that has had an active year in the Australian and New Zealand markets, coming back for a second, third or fourth transaction. It certainly feels, though, that the second half has been the right time to bring deals as conditions improve.”

Nonbanks are also holding fast to their belief that competition in the mortgage sector may be easing. Austin says bank practices such as delaying interest rate increases to deposit holders – which made their funding cheaper – and cash back offers to attract new mortgage business made it “incredibly hard to compete.”

However, he says these practices have been less prominent since mid-year and Firstmac’s prime mortgage originations have increased ever since. The issuer is eyeing Q1 2024 for a new benchmark prime RMBS transaction and its second auto ABS deal. “We are back to 2019 levels of prime origination and writing quite good volumes again,” he tells KangaNews. “This largely reflects the unwinding of the term funding facility, which removed the free kick for banks.”

Angle Auto has been laying the groundwork for frequent issuance. “We made a very strong point at the time of our first deal that we will be a repeat issuer, in size, of relatively vanilla transactions,” he tells KangaNews. “The new deal demonstrates that we are going to do what we said we would – everything is structurally the same as the debut. It was easy for investors to come into the book again because there was no new work for them to do.”

The size of Angle Auto’s book and origination aspirations mean it could be active in the public securitisation market as frequently as three times a year, Mixter adds. This could mean a new deal as early as Q1 next year, should market conditions support it.

The signs are also positive for ongoing deal flow for the balance of 2023. The first days of November saw Pepper Money price a prime RMBS deal for A$750 million and Zip Co print A$300 million of personal loan ABS, while RedZed and MA Money were also marketing nonconforming RMBS deals at the start of the month.

nonbank Yearbook 2023

KangaNews's eighth annual guide to the business and funding trends in Australia's nonbank financial-institution sector.