Kommunalbanken Norway

| SECTOR | Agency |

| RATINGS | AAA/Aaa |

| RATING OUTLOOK | Both stable |

| FUNDING VOLUME 2019/20 |

US$8BN/US$10BN |

| RISK WEIGHT | 20% |

| REPO ELIGIBILITY |

Norges, US Fed, SNB, RBNZ, RBA |

About Kommunalbanken Norway

Kommunalbanken Norway (KBN) was established by a Norwegian act of parliament in 1926 and is 100% government-owned. KBN has a public-policy mandate to provide low-cost funding to the local-government sector.

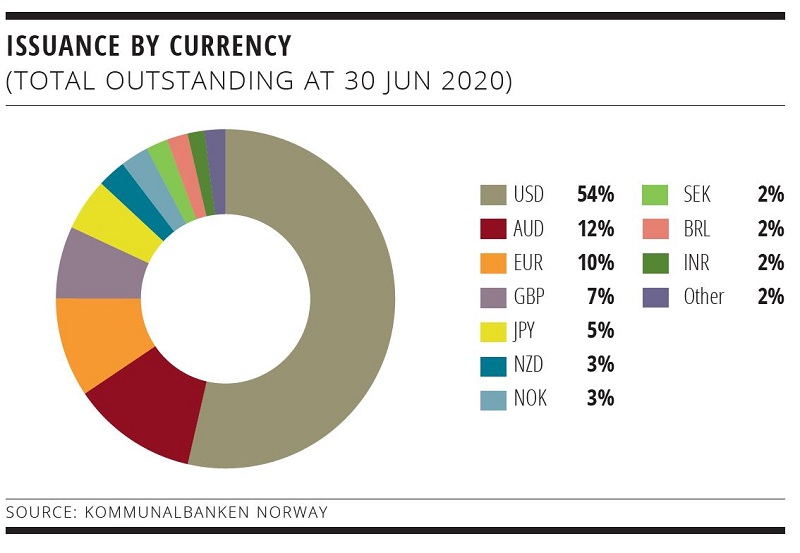

Due to large accumulated budget surpluses, currently at approximately 300% of GDP, the Kingdom of Norway does not issue any foreign-currency debt. KBN is the closest proxy to Norwegian sovereign debt available in the international capital markets. As a result, KBN offers investors a unique opportunity to gain exposure to the Norwegian public sector and one of the wealthiest economies globally.

Sustainable funding strategy

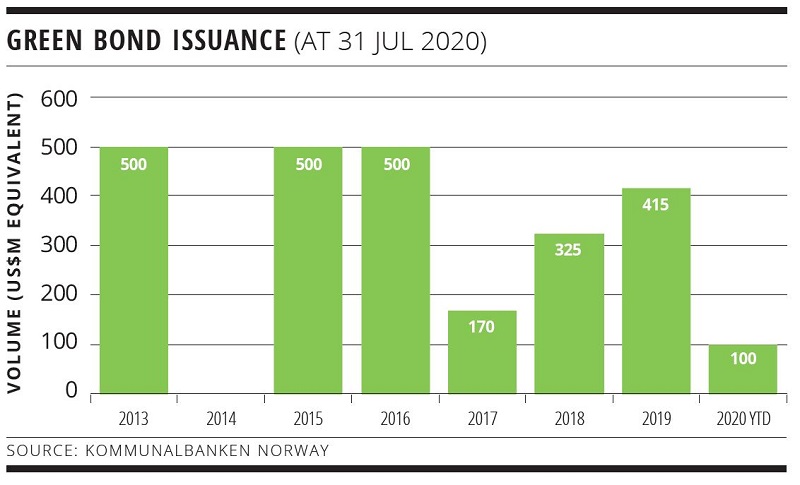

In 2010, KBN launched its green-loans product, a reduced-rate loan for investments in the Norwegian local-government sector that contribute to solving the climate challenges of the future. The government wants KBN to be a driving force in the development of the market for green financing in Norway.

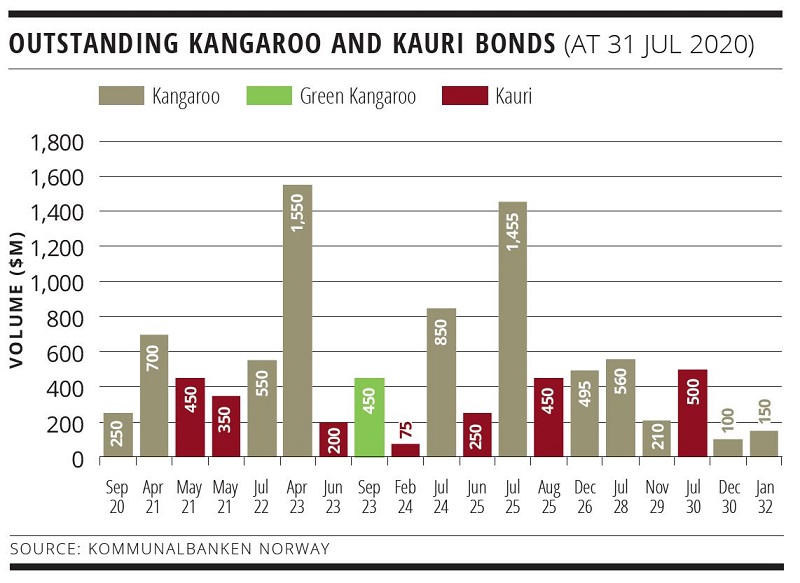

In 2013, KBN was one of the first European SSA issuers to launch a public US dollar green bond. Since then, the demand for green loans has risen dramatically, mirroring the increased interest for green bonds. At year-end 2019, KBN had around US$2.5 billion outstanding in green loans and around US$2 billion outstanding in green bonds. KBN has issued green bonds in USD, NOK, SEK and AUD.

KBN will continue to be an active issuer in the green-bond market as its green loans continue to grow. KBN’s strategy is to focus on various global markets where there is a clear environmental, social and governance focus from investors.

SUSTAINABILITY OBJECTIVE OF GSS BOND PROGRAMME

Through its Green Bonds and Green Loans Framework, KBN supports Norwegian local-government investments targeting climate-change mitigation and adaptation, and other environmental management. Green loans are given a discounted interest rate and are meant as an incentive for sustainable investments in the local-government sector.

REFERENCE TAXONOMY FOR THE USE OF PROCEEDS

Green Bond Principles and own categories based on Nordic Public Sector Issuers Position Paper on Green Bond Impact Reporting. Project categories are buildings, renewable energy, transportation, waste management, water and waste-water management, land use and area projects, and climate-change adaptation.

| GSS BOND PROGRAMME | Green Bond Programme |

| FRAMEWORK WITH WHICH THE GSS BOND PROGRAMME IS ALIGNED | Green Bond Principles. The framework is subject to an update in 2020. |

| EXTERNAL REVIEW PROVIDER | CICERO Shades of Green (Framework: dark green, 2016) |

PUBLIC ISSUER ESG RATINGS/SCORES

| INSTITUTION | RATING/SCORE (all unsolicited) |

|

CDP ISS-oekom |

First reporting conducted August 2020, awaiting score C (July 2019) |

FOR FURTHER INFORMATION PLEASE CONTACT:

Thomas Møller, Head of Funding and Investor Relations

+47 2150 2041 • This email address is being protected from spambots. You need JavaScript enabled to view it. • www.kbn.com

SSA Yearbook 2023

The annual guide to the world's most significant supranational, sovereign and agency sector issuers.