Kāinga Ora - Homes and Communities

About Kāinga Ora

Kāinga Ora – Homes and Communities was established on 1 October 2019, to combine the KiwiBuild Unit with Housing New Zealand Limited (HNZL) and its development subsidiary, HLC 2017 Limited. This has enabled a more cohesive approach to delivering the government’s housing priorities.

Kāinga Ora has two key roles: being a world-class public-housing landlord and partnering with the development community, Maori, local and central governments, and others on urban development. Kāinga Ora provides tenancy services as well as maintaining and developing around 66,300 units of public housing stock, and providing home-ownership products and other housing-related services.

Ownership

Under the Kāinga Ora Homes and Communities Act 2019, Housing New Zealand Corporation was disestablished, and its functions and assets were vested in new Crown agent called Kāinga Ora – Homes and Communities, which is 100% Crown-owned. HNZL and Housing New Zealand Build Limited continue to operate, as wholly owned subsidiaries of Kāinga Ora. HLC 2017 Limited has been disestablished.

Guarantee structure

The New Zealand government does not explicitly guarantee Kāinga Ora debt. Even so, Kāinga Ora enjoys credit ratings equal with the New Zealand sovereign.

Debt position

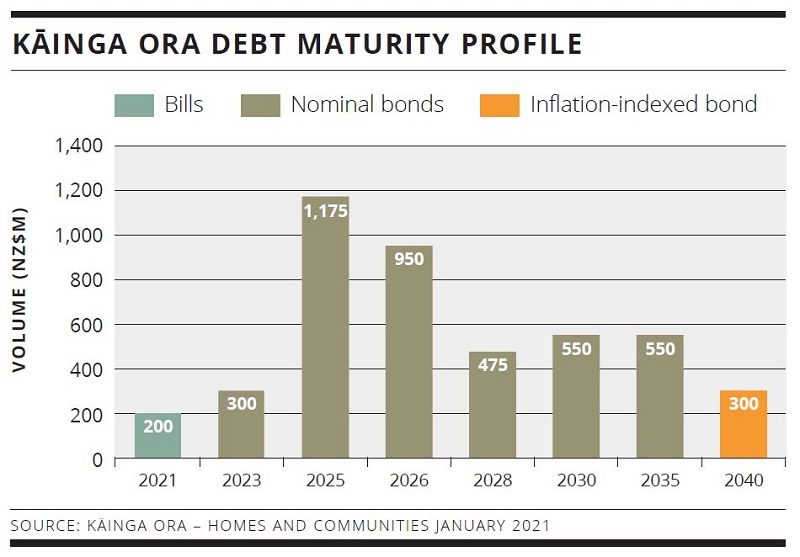

Kāinga Ora has NZ$6.5 billion of debt outstanding as at 31 January 2021, comprising NZ$2 billion in Crown loans and NZ$4.5 billion in market debt. The latter includes NZ$4.3 billion of domestic bonds and NZ$200 million of bills. The agency’s borrowing protocol now allows for up to NZ$7.1 billion of debt to be sourced from capital markets.

| SECTOR | AGENCY |

| CREDIT RATINGS (S&P/M) LONG-TERM NZD |

AAA/Aaa |

| CREDIT RATINGS (S&P/M) LONG-TERM FOREIGN CURRENCY |

AA+/Aaa |

| FOREIGN-CURRENCY PROGRAMMES | None |

| FOREIGN-CURRENCY ISSUANCE SINCE JAN 2020 |

N/A |

| TERM FUNDING REQUIREMENT (A$BN) |

FY21 FY20 FY19 1.6 2.3 0.8 |

| RBA REPO ELIGIBLE | NO |

| RBNZ REPO ELIGIBLE | YES |

Financing strategy

By 30 June 2021, HNZL is expected to have around NZ$5.2 billion of domestic bonds on issue, depending on required financing and market conditions.

In November 2020, Kāinga Ora announced a bond tender programme that will account for half the annual borrowing requirement. Tenders tap existing nominal lines only, providing greater liquidity and access to new investors.

Kāinga Ora remains focused on building a New Zealand dollar bond curve, having established 15-year nominal tenor. Separately, Kainga Ora has also issued a 20-year inflation-indexed bond.

Kāinga Ora issues all bonds as wellbeing bonds under its sustainability-financing framework. From its inception in 2018 up to FY20, 89% of proceeds have been attributed to the social housing, and socioeconomic advancement and empowerment eligible social categories. The remaining 11% has been attributed to the green buildings, and pollution prevention and control-eligible green categories.

Kāinga Ora expects green impacts to increase proportionally in use of proceeds over time, having committed to all contracted new builds being 6 Homestar certified and recently undertaken its inaugural carbon-emissions profile.

Kāinga Ora is an active bills issuer, including regular fortnightly tenders of NZ$25 million, and private placements as required.

FOR FURTHER INFORMATION PLEASE CONTACT:

Nicola Reeves

Liquidity and Investor Relations Manager

+64 4 439 3249

This email address is being protected from spambots. You need JavaScript enabled to view it.

Sam Direen

Treasurer

+64 4 439 3939

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.kaingaora.govt.nz

HIGH-GRADE ISSUERS YEARBOOK 2023

The ultimate guide to Australian and New Zealand government-sector borrowers.