Liberty Financial

About Liberty Financial

Liberty Financial is a mainstream speciality-finance group that champions free thinking. Since 1997, Liberty has helped more than 600,000 customers “get and stay financial”.

Liberty provides a wide range of products and services comprising home, car, commercial, self-managed super-fund and personal loans, and investment and deposit products. Liberty also offers consumer loan-protection solutions via its group companies ALI Group and LFI Group.

A multichannel distribution strategy supports Liberty’s loan-origination activity. Liberty offers products through mortgage and motor-vehicle-finance brokers, financial planners and direct to consumers. Liberty also distributes products and services through three company-owned networks: Liberty Network Services (more than 160 advisers) and National Mortgage Brokers (more than 450 brokers) in Australia, and Mike Pero Mortgages (more than 60 franchisees) in New Zealand.

Liberty provides solutions to a wide range of customers, from people who could be serviced by mainstream providers to those who need or are searching for a customised solution. Since its formation in 1997, Liberty has consistently applied technological advances to pursue multiple markets through its customised risk-management and operational practices. Customised technology is not only necessary to conduct a diversified-finance business but it also enables Liberty to design its financial products and services to evaluate, assess, arrange and manage solutions effectively for customers.

| SIZE OF LOAN BOOK | A$12.3BN |

| MAKEUP OF LOAN BOOK |

PRIME RESIDENTIAL MORTGAGES: 71% |

| GEOGRAPHIC DISTRIBUTION OF LOAN BOOK | AUSTRALIA: 98% NEW ZEALAND: 2% |

| OUTSTANDING DEBT ISSUANCE | SECURITISATION: A$11.1BN SENIOR UNSECURED: A$1.1BN |

Liberty deploys its own capital in its operations, thereby reducing financial and operating leverage. By aligning its interests to the way its long-term assets perform, Liberty is dedicated to deciphering the fundamental relationship between risk and return. In so doing, the company’s loan performance is the best in its class.

Liberty has a “strong” servicer ranking for prime and nonprime mortgages, auto loans and commercial-mortgage servicing, all from S&P Global Ratings (S&P).

Ownership and capital structure

Liberty is Australia’s only investment-grade rated nonbank issuer (BBB-, outlook positive by S&P).

It is a publicly listed company following its successful IPO in December 2020. The founding shareholders established the business in 1997 are still the majority shareholders to this day.

An independent board of directors with decades of relevant financial-services and insurance experience oversees Liberty’s operations.

Funding strategy

Liberty has established and maintains a flexible, durable and diversified funding programme. The company has multiple sources of funding. It has A$1 billion of equity capital, A$6 billion of wholesale-funding limits and A$1 billion of outstanding medium-term notes. It is the only Australian non-bank financial institution to have a senior-unsecured funding programme.

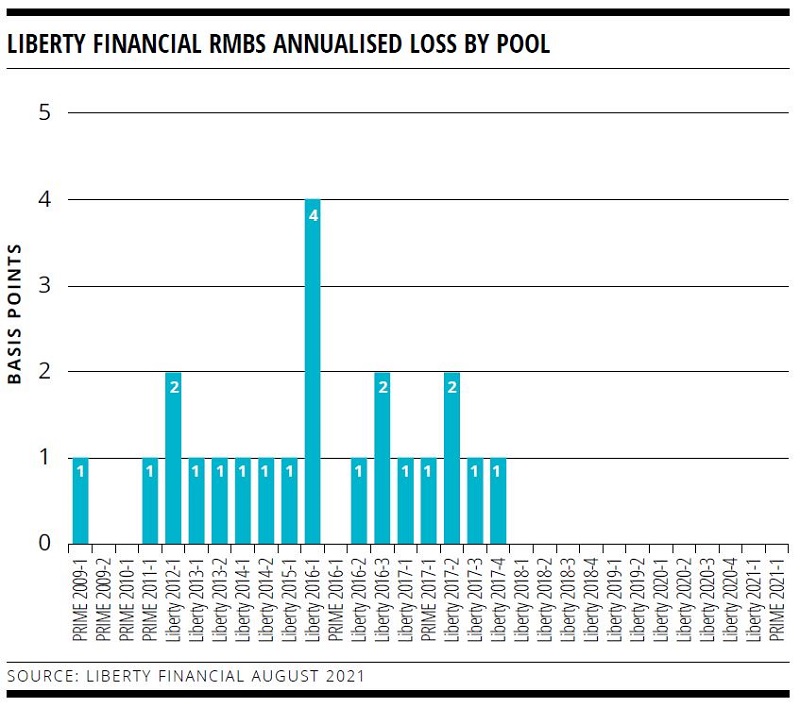

Liberty’s term securitisation programme provides investors the opportunity to buy fixed-income securities in prime and nonconforming RMBS, auto ABS and SME formats. Liberty has raised more than A$35 billion in domestic and international capital markets across 77 transactions. Liberty has an unblemished capital-market track record whereby its rated notes have never been charged off, downgraded or placed on negative watch.

FOR FURTHER INFORMATION PLEASE CONTACT:

Peter Riedel

Chief Financial Officer

+61 3 8635 8888

This email address is being protected from spambots. You need JavaScript enabled to view it.

www.liberty.com.au

nonbank Yearbook 2023

KangaNews's eighth annual guide to the business and funding trends in Australia's nonbank financial-institution sector.

WOMEN IN CAPITAL MARKETS Yearbook 2023

KangaNews's annual yearbook amplifying female voices in the Australian capital market.