NOW Finance

| SIZE OF LOAN BOOK | A$650M | ||

| MAKEUP OF LOAN BOOK | Consumer unsecured lending: 65% Consumer secured lending: 35% | ||

| GEOGRAPHIC DISTRIBUTION OF LOAN BOOK | Australia: 100% | ||

| OUTSTANDING DEBT ISSUANCE | Warehouse facilities NOW Trust ABS programme |

||

About NOW Finance

NOW Finance is a private company operating as a nonbank lender in the Australian consumer loan market. The company provides unsecured personal loans, secured personal loans and asset loans to consumers looking for convenient, value for money and hassle-free personal finance solutions that enable them to achieve their goals and maintain financial control.

The business offers high-quality products and customer experience to provide consumers with a viable alternative to the major banks.

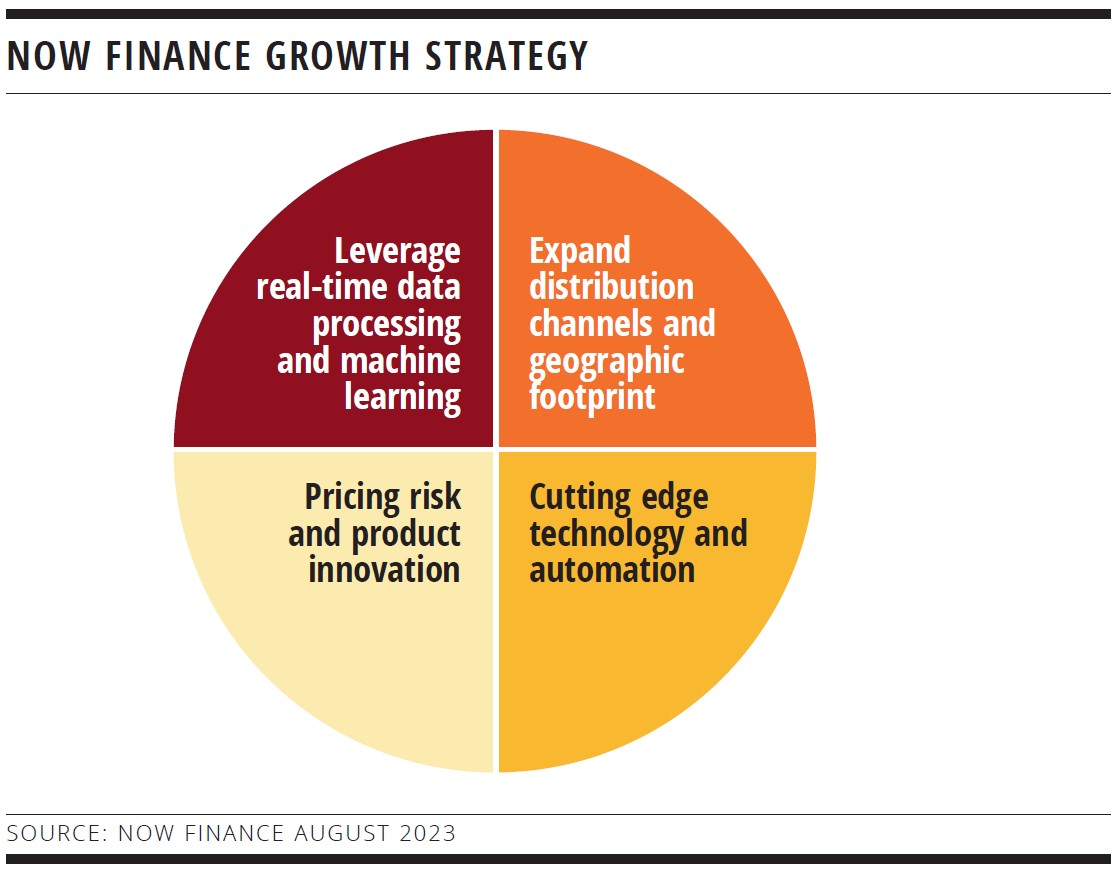

NOW Finance has built and rapidly scaled its consumer lending solutions based on four key tenets:

• Cutting-edge technology and automation.

• Pricing, risk and product innovation.

• Real-time data processing and machine learning.

• Trusted partnerships.

A state-of-the-art technology platform and differentiated product offering allow NOW Finance to originate a diversified portfolio of high-quality consumer loans. These capabilities underpin NOW Finance’s white-label platform and its partnership with Pepper Money.

Data is the digital currency for any nonbank lender and is a cornerstone of the NOW Finance business. The company’s investment in technology delivers significant benefits in customer acquisition, risk management and pricing. It has also been key to NOW Finance’s ability to scale quickly and efficiently.

The company’s cloud-first infrastructure strategy provides the business with significant capacity, high availability and maximum flexibility.

Ownership and capital structure

NOW Finance is an Australian-owned, founder-led fintech based in Melbourne, with offices in Sydney, Brisbane and Perth. It has developed a stronghold in the consumer loan market as a leading alternative to the major banks.

Asset performance

The NOW Finance loan book typically follows industry and seasonal trends, but at superior levels. Delinquencies continue to track well below the industry in the 30-plus days past due and 90-plus days past due categories.

Funding strategy

A balance sheet lender since inception, NOW Finance has developed an institutional-grade funding platform with a diverse range of bank and institutional investors, as well as an established, publicly rated ABS programme.

NOW Finance executed its inaugural NOW Trust 2019-1 ABS transaction in September 2019, with three follow-on transactions totalling A$850 million by the end of August 2023. The success of the programme demonstrates the strong and growing appetite of institutions to invest in a strategically diversified loan portfolio, seasoned and originated within a proven risk management framework.

Risk management

NOW Finance uses a rigorous credit assessment and risk framework, underpinned by a proprietary multifactor pricing and decision engine. This capability enables NOW Finance to originate a prime-quality portfolio and consistently deliver market-beating credit quality measures.

NOW Finance’s strong risk management capability and strategy provide a reliable risk profile for investors and partners alike.

Business performance

NOW Finance has defended a strong net interest margin and maintained receivable credit quality in a competitive market. It will continue to scale and diversify through its operating leverage, risk culture and strong cost management.

FOR FURTHER INFORMATION PLEASE CONTACT:

James Cunningham

Treasurer

+61 499 300 697

This email address is being protected from spambots. You need JavaScript enabled to view it.

nonbank Yearbook 2023

KangaNews's eighth annual guide to the business and funding trends in Australia's nonbank financial-institution sector.