INVESTORS SEEK TO GET AHEAD OF GREENWASHING RISK

Greenwashing has become a focus of regulatory and media attention in Australia in recent times, with the investment community well and truly in the crosshairs. Fixed-income investors report an elevated – but manageable – degree of concern.

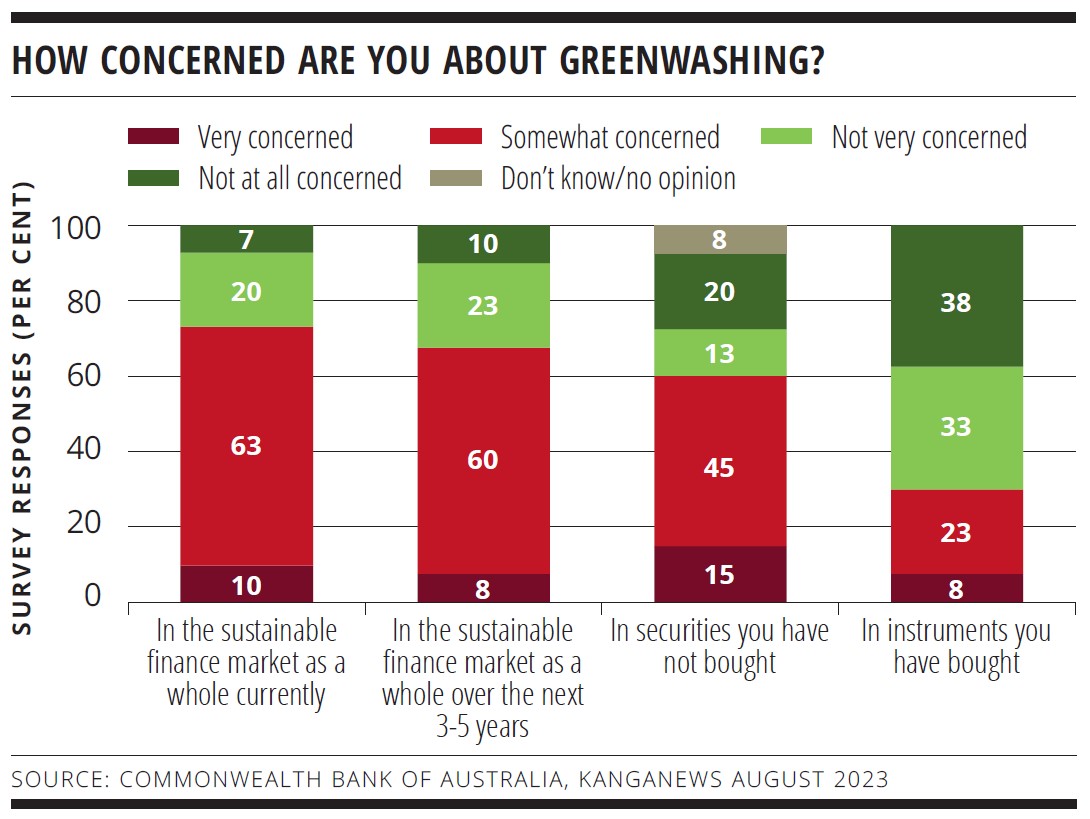

The Commonwealth Bank of Australia (CBA)-KangaNews survey suggests nearly three-quarters of investors are currently at least somewhat concerned about greenwashing risk in the sustainable finance market as a whole (see chart).

The large majority of these responses are only “somewhat” concerned, however. Investors also seem to be confident in their own ESG analysis: while 60 per cent of survey respondents express concern about greenwashing in securities they have not bought, only half as many extend this concern to their own holdings.

Nonetheless, greenwashing risk is clearly top of mind for investors. The number of pending cases brought by the Australian Securities and Investments Commission Against investment firms for alleged mislabelling or misleading environmental, social and governance (ESG) conduct continues to mount. Investors are wary of being caught up in such a case – or in negative media coverage – due to what might be inadvertent behaviour.

“We have seen a number of investors in Europe get in trouble for mislabelling and we are certainly taking an ultra-cautious approach to the evolution of green-labelled products,” reveals Ben Squire, executive director and head of credit research, Asia Pacific at UBS Asset Management. “Reputation is really important and we want to avoid any element of greenwashing risk.”

Unfortunately, there may be a particular challenge when it comes to the most valuable role capital can play in decarbonisation: funding the transition to a low-carbon economy. The fundamental problem is that financing high-emitting industries can increase portfolio emissions and trigger exclusion policies, even if the subject of the investment has a credible and ambitious transition strategy – or, indeed, if the investment is specifically to fund transition. Such exposures in a labelled ESG or green fund are potentially susceptible to accusations of greenwashing.

“We hear different views on the value of labelled bonds when it comes to credibility,” reveals Charles Davis, managing director, sustainable finance and ESG at CBA.” Investors tell us the external review and ongoing reporting associated With a label provides value. But the label alone does not provide automatic credibility.”

A way forward may be to develop options in the funds universe. “One solution could be to perhaps establish labelled transition funds,” suggests CBA’s head of ESG DCM origination, Lauren Holtsbaum. “We have seen this offshore – a willingness to invest in high-emitting issuers with credible transition plans that potentially provide more impact. The fund distinguishes these investments as ‘transition’ rather than ‘dark green’.

Market participants hope the Australian sustainable finance taxonomy will offer guidance on transition.